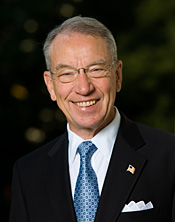

From Senator Charles Grassley –

The Obama administration’s latest move to push the reset button on the most far-reaching overhaul of the nation’s health care policy in four decades offers a vital teachable moment.

For starters, the systemic flaw of the law enacted in 2010 and written to take effect at the end of this year puts one-sixth of the U.S. economy into the hands of Uncle Sam. This means the long arm of federal law will reach further into the back pockets of the taxpaying public, impact medical decisions affecting patients and health care providers and stifle growth and innovation with new taxes and stiff penalties. It grows big government as American taxpayers are told to make do with less.

During what became a polarizing national debate, a bipartisan approach was kicked to the White House curb when efforts to broker broad-based, consensus reform broke down. That’s when the President pursued a partisan reform bill that made its way through Congress on a party-line vote.

Looking through the rear view mirror, the bumps in the road that have stalled implementation of the Affordable Care Act should come as no surprise. The then-Speaker of the House quipped about the 2,000 pages of legislation, “We have to pass the bill so you can figure out what’s in it.” Now, it is ironic, possibly disingenuous, and perhaps unconstitutional that the Obama administration is choosing to ditch certain parts of the law when it’s politically convenient to do so.

Instead of enjoying widespread public support, the law is causing widespread confusion. And, many states have opted not to expand Medicaid and not to create their own insurance exchanges due to the unsustainable spending and regulatory burdens that come with the law.

The rocky implementation of the Affordable Care Act has been described by a leading Democratic senator as a “train wreck.” Again, that should come as no surprise as passage of the law was railroaded through Congress without the American public on board.

So what’s happened in the three years since President Obama signed the bill into law on March 23, 2010?

The Department of Health and Human Services (HHS) has granted delays, suspensions and waivers on a regular basis. Once again, the federal bureaucracy is lowering the bar of expectations and fueling public cynicism about the government’s ability to deliver as promised and with any accountability.

Consider just two of the most recent setbacks:

• the Government Accountability Office (GAO) last month reported that “critical” activities needed to create a federal insurance exchange have not been completed, raising concern that the October 1 deadline faces serious challenges.

• HHS announced in July a one-year delay for the mandate requiring employers with 50 or more employees to offer health care coverage.

Although the most recent HHS decree gives business owners a bit of breathing room before the employer mandate takes effect, it further unravels false promises about the Obama health care law being fiscally responsible, and it doesn’t erase the law’s chilling effect on job creation and business expansion down the road.

Creating a vast new public entitlement creates tremendous risk for fraud, as well. Despite President Obama’s assurance that his health care reform would not add “one dime to the deficit,” history teaches us that these programs not only saddle future generations of Americans with burdensome taxes, but they also provide an ocean’s supply of fish for fraudsters to reel in, hook, line and sinker.

From my positions on the Senate Finance and Judiciary Committees, I work to recapture improper payments through aggressive legislative and oversight measures. Working to restore integrity to health care, farm and defense programs, I champion internal audits by independent inspectors general and advocate whistleblower protections for those who report financial mismanagement and wrongdoing.

The U.S. Treasury has long been milked as a cash cow by unscrupulous opportunists who exploit government programs for ill-gotten financial gain. In 1986, I co-authored updated anti-fraud tools first signed into law by President Abraham Lincoln. My “qui tam” amendments that empower whistleblowers to expose fraud are credited with recovering $35 billion.

With less than two months before the health care exchanges are slated to open for business, the risk of fraud and improper payments is virtually guaranteed. And yet HHS has chosen not to certify who lawfully qualifies for taxpayer subsidies that are projected to average more than $5,000 per person.

Consider this:

• Social Security improperly paid out $7.9 billion in the last fiscal year.

• The Treasury inspector general says as much as 21 percent to 25 percent of the Earned Income Tax Credits are awarded to those who don’t legally qualify.

• The GAO reported in February that the Medicare program remains “high-risk” for improper payments, reaching $44 billion in 2012.

One would think the White House would be concerned about fraud tarnishing the crown jewel of the president’s domestic agenda. Instead it appears the Obama administration is too busy reshuffling the deck chairs on the Titanic to worry about crosschecking eligibility requirements for the massive new entitlement.

The president may have been seeking to put a feather in his cap with passage of his health care reform plan. Instead, the legacy that President Obama’s health care law would leave behind stands to hoodwink taxpayers and run job creators off the rails.

Kill grandma, Chucky. Wingnut