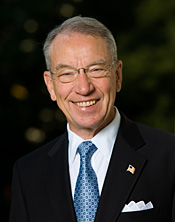

From Iowa Senator Charles Grassley –

Q: What exactly is the fiscal cliff?

A: The fiscal cliff is a term being used to describe a set of federal tax increases and spending cuts that will occur if Congress and the President don’t act. Most immediately, the failure to extend tax relief that is scheduled to expire at the end of this year would result in a $310 billion tax increase in January. This tax increase would hit all taxpayers, undermine small businesses and be a drag on the economy. Some experts, including those at the nonpartisan Congressional Budget Office, find that such a large tax increase could put the still struggling economy back into a recession. Separately, the Budget Control Act, enacted in August 2011, increased the statutory debt limit and created a Joint Select Committee that was to find up to $1.5 trillion in deficit reduction by November 23, 2011. The law said that if the select committee didn’t propose legislation to reduce the deficit, then a mandatory budget cut, called “sequestration,” will take effect. The committee did not reach agreement, so a reduction in government spending equal to $1.2 trillion over a ten-year period will go into effect automatically. These cuts are allocated equally between defense and non-defense beginning January 2, 2013, although a number of mandatory programs are exempt from sequestration, including Social Security and Medicaid.

Q: What’s the impact of the fiscal cliff?

A: I hear regularly from Iowa employers about how uncertain tax policy, along with the threat of costly new regulations from Washington, prohibits them from being able to make pro-growth decisions including hiring new workers. Part of the tax policy scheduled to expire is the bipartisan tax relief package enacted in 2001. It includes across-the-board income tax relief, marriage penalty relief, tax relief for college tuition, and a reduced tax rate on the lowest levels of income to 10 percent from 15 percent. This package of relief was extended at the end of 2010 for another two years through a bipartisan agreement reached between members of Congress and the President. If it’s not extended again this year, a family of four earning $50,000 will be hit with a $2,183 tax hike. Small business owners could face marginal tax rate hikes of 17 to 25 percent, depending on their effective marginal rates. In addition, there are over 60 temporary provisions that expired in 2011 and another 40 that are expiring this year. These include tax credits for the production of wind energy, biodiesel and cellulosic ethanol. These industries support good paying jobs here in America, jobs that are slowly disappearing as Congress and the President continue to fail to act.

Q: What stands in the way of Congress and the President’s taking action?

A: Experts say raising taxes on small businesses would hurt workers and job creation. Yet, tax increases remain a serious threat due to inaction, especially by the leadership of the Senate majority. Earlier this year, the Senate voted on a proposal to extend current tax policy for a year, but it was narrowly defeated. On August 2, 2012, the Finance Committee, of which I am a senior Member, passed The Family and Business Tax Cut Certainty Act which would extend many of the expired and expiring tax provisions, but the full Senate didn’t take up the bill. As far as sequestration, the House of Representatives has passed the Sequester Replacement Reconciliation Act, which would make additional cuts to non-defense spending and add reforms to mandatory spending to protect defense budgets from spending cuts. Without such an alternative, the Defense Department is scheduled to absorb 50 percent of the sequestration cuts even though military spending comprises 20 percent of the federal budget. So far, leadership for the Senate majority has refused to act on legislation as the House did. So, tax increases and spending cuts are in limbo. The next opportunity for Congress and the President to address these issues will be after the election. The uncertainty all year has worked against what Washington needs to do to foster an environment for economic activity and job creation in the private sector.