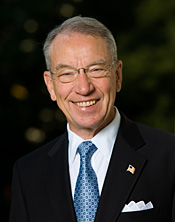

Question and answer with Senator Charles Grassley on reforming the federal tax code:

Q: Why do you insist that tax reform remain “revenue neutral” as Congress begins work on rewriting the federal tax code?

A: It’s the only way to prevent big spenders from growing big government. The White House isn’t interested in lowering tax rates and eliminating distortions in the tax code to help generate jobs and economic growth. Instead, the President and his supporters want to use tax reform as a platform to raise the lid on tax rates and grow the government’s share of revenue. At great risk to America’s long-term economic prosperity, this point of view ignores the U.S. long-term fiscal challenges arising from the looming growth of entitlement spending. Uncle Sam needs to increase the size of the economic pie through the pro-growth effects of tax reform. Although it is widely agreed the federal tax code needs a top-to-bottom, inside-and-out overhaul, the consensus from that point forward comes to a screeching halt. When Congress and President Reagan successfully passed the 1986 tax reforms, lawmakers were able to achieve success thanks in large measure to a bipartisan agreement that reform would be revenue neutral from start to finish. The Senate leaders of the tax-writing Senate Finance Committee are casting a wide net to closely examine the merits of tax expenditures. As lawmakers weigh the benefits of closing loopholes, ending tax breaks and trimming tax credits, exemptions and deductions, Congress cannot afford to slide down the slippery slope embraced by those who champion big government. Put simply, America cannot tax and spend its way to prosperity. Raising taxes, redistributing wealth and unleashing even more government spending would send America down a dead-end road of broken promises. Washington kicked off the new year by increasing taxes more than $600 billion. The nonpartisan Congressional Budget Office says federal tax revenues and federal spending are on track to exceed historical averages. The 113th Congress can make history by cleaning up the tax code and getting the U.S. fiscal house in order. That can happen if policymakers would agree on the premise that tax reform starts with revenue neutrality and makes it all the way through to the finish line.

Q: What other principles are you promoting during debate on tax reform?

A: Tax reform should reward hard work and encourage savings and investment. For example, a pro-growth approach would eliminate double taxation; bring more certainty to investors and risk takers by making temporary tax incentives permanent; and make the U.S. tax structure more competitive internationally. The federal tax code should not serve as a barrier that keeps businesses from staying, relocating or expanding their business here in America. I shared these points of view with the leaders of the Finance Committee in response to their request for senators’ priorities for tax reform. If Congress seizes this opportunity to wipe the slate clean and overhaul the U.S. tax system, I will continue to advocate for fairness, simplicity, and comprehensive reforms, including both corporate and individual taxes.

Reagan is dead. So what? That is history and has nothing to do with what is happening today.

President Reagan raised taxes 11 times.

Wingnut!