DES MOINES – Data centers are significantly increasing overall electricity demand in Iowa and across America, and a new forecast claims the strongest four-year growth in U.S. electricity demand since 2000 is on the way, fueled by these mega-computing behemoths.

DES MOINES – Data centers are significantly increasing overall electricity demand in Iowa and across America, and a new forecast claims the strongest four-year growth in U.S. electricity demand since 2000 is on the way, fueled by these mega-computing behemoths.

Data center electricity usage is driving up power bills for residents as utilities build new infrastructure, with forecasts showing potential rate hikes of 14-26% in Iowa due to these factors and broader energy trends, meaning your bill will likely rise as the grid struggles to keep pace with AI-driven growth.

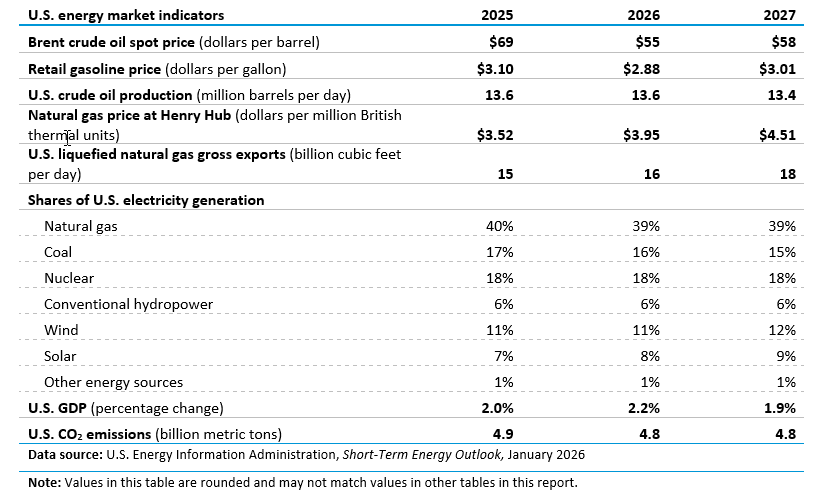

Today, the U.S. Energy Information Administration (EIA) published its first energy-sector forecasts through 2027 in the January Short-Term Energy Outlook (STEO).

EIA expects U.S. electricity use to grow by 1% this year and 3% in 2027. This increase would mark the first time since 2007 that power demand has risen for four years in a row and the strongest four-year growth period since 2000. The driving factor behind this surge is increasing demand from large computing centers.

“U.S. energy production remains strong, and natural gas output is expected to grow to nearly 109 billion cubic feet per day this year,” said Tristan Abbey, Administrator of the U.S. Energy Information Administration. “Natural gas supply is critical as we forecast that U.S. liquefied natural gas exports expand and electricity demand rises through 2027, driven largely by increasing demand from large computing facilities, including data centers.”

Other key takeaways from the January STEO are below.

U.S. energy market indicators

Venezuela: EIA’s forecast assumes existing sanctions on Venezuela remain in place through 2027. Any change in sanctions or other U.S. government policy related to Venezuela that could result in more oil production than we assumed in this forecast would put additional downward pressure on oil prices.

Global oil production: EIA expects global production of liquid fuels to outpace demand and increase inventories, driving the price of Brent crude oil down to average $56 per barrel in 2026, a 19% drop from 2025. EIA expects these lower prices ($52 per barrel for West Texas Intermediate) to reduce drilling activity, causing

U.S. crude oil production to decline by less than 1% in 2026 (to 13.6 million barrels per day from a record high in 2025) and 2% in 2027.

U.S. gasoline prices: EIA expects U.S. retail gasoline prices to decrease in 2026, due to lower crude oil costs, and to remain relatively flat next year. The forecast U.S. retail gasoline price averages around $2.90 per gallon (gal), a drop of nearly 20 cents/gal from 2025.

Natural gas prices: EIA expects the benchmark Henry Hub price to stay mostly flat in 2026, averaging just under $3.50 per million British thermal units (MMBtu), before rising to $4.60/MMBtu in 2027. This increase is driven by growing demand for liquefied natural gas exports and higher natural gas consumption in the electric power sector, which is expected to outpace growth in natural gas production.

Electricity generation: Solar power supplies the largest increase power generation, increasing by a forecast 21% in both 2026 and 2027 following the addition of almost 70 gigawatts of new capacity; natural gas generation is forecast to remain flat in 2026 before increasing by 1% in 2027, while coal-fired power generation is expected to fall by 9% in 2026 and remain flat in 2027.

Why Your Bill is Rising:

- Massive Demand: Data centers, especially for AI, consume enormous amounts of power, straining existing grids.

- Infrastructure Costs: Utilities must build new generation and transmission lines, with these large capital costs distributed among all ratepayers, not just data centers.

- Supply vs. Demand: The rapid growth in data center demand is outpacing new energy supply, pushing up wholesale electricity prices, which then affect residential rates.

- Iowa-Specific Projections: Some models predict Iowa electricity rates could increase by 14% to 26% due to factors including data center growth and changes in energy policy.

2 thoughts on “Electricity bills could soon soar as power demand surges, feds say”

Love the picture. Apparently she can afford nose ring, tattoos and fancy t-shirt, but not her electric bill.

And multiple kids probably with multiple daddies … she alienated every one of them from the kids lol. It’s how they operate.