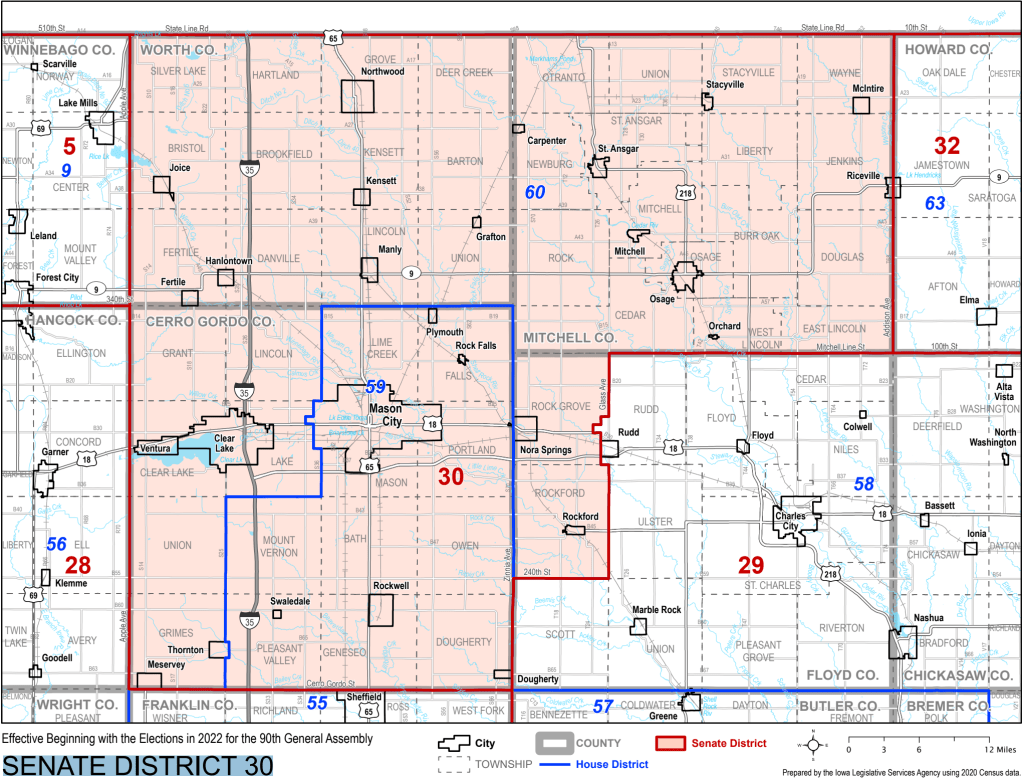

The following is a legislative update from Republican State Senator Doug Campbell of Mason City, representing portions of Worth, Mitchell, Cerro Gordo and Floyd counties in Iowa Senate District 30:

With our first legislative deadline on Friday, the Senate was busy with subcommittees and committees, working to get our bills through. Every day was filled with a wide range of topics, and some committees would even have to take a break and come back later in the day. With such a busy week, we advanced legislation on a number of important issues, priorities of the governor, and issues brought to us by constituents.

Eminent domain legislation has passed the House and will be further considered in the upcoming days and weeks.

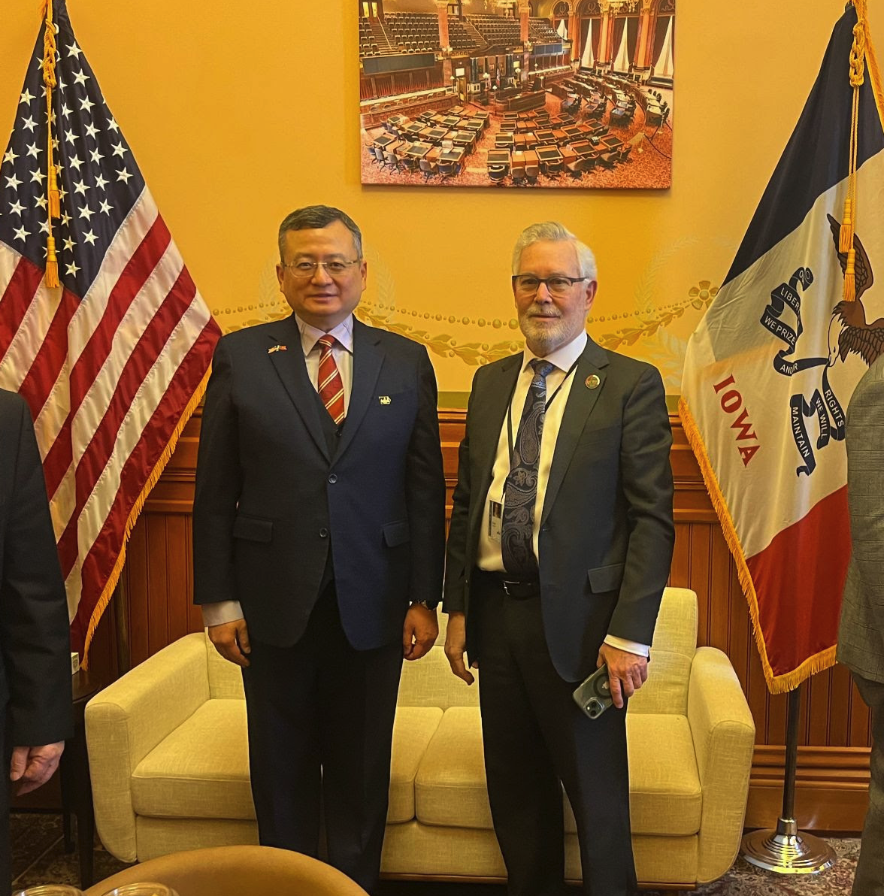

Director General Dennis Yen-Feng Lei thanked the House for support and billions of dollars of direct trade between Taiwan and Iowa. The Director General visited the Senate and was warmly welcomed. I had the pleasure to meet with him personally in the President of the Senate’s office.

The House also discussed HF 712. The purpose is to encourage manufacturers to follow current Good Manufacturing Practices as outlined in FDA Title 21 and remove immunity from liability.

On Tuesday, the Senate Education Committee unanimously approved SF 237 to help study the effects technology is having on kids in their daily lives. The bill directs the Department of Education, working with the Department of Health and Human Services, to put together a working group to review research regarding the impact of school-provided technology on students’ cognitive function. This review would include recommendations on best practices for the use of school-provided technology in educational contexts and a focus on how to mitigate its negative impacts on social and behavioral development, attention span, mental concentration, and learning ability. While technology has made for a more efficient learning environment and been a useful tool in many instances, we will continue to look for ways to improve the quality of our education system and ensure students are in an academic environment beneficial to their success.

We look forward to hearing from you. Reach out with your questions and concerns. I finished responding to most of the 2342 emails that I have received since the last newsletter. I apologize if I did not give you a timely or personal response.

Historic property tax relief proposal for Iowa homeowners

In 2023, the legislature passed major property tax reform, House File 718, in response to concerns from constituents all across the state amid rising assessments. The goal was control the growth of property taxes, increase transparency about local government spending, and urged local governments to budget responsibly and focus on priorities.

House File 718 was an important step in reforming our property tax system, bringing to light a number of other issues to be evaluated and addressed. It set the stage for changes to prioritize Iowa property taxpayers, continue limiting the growth of local spending, and provide more certainty and transparency.

This week, Senate Republicans released the next step in reforming property taxes in Iowa and making the system simpler and fairer. It builds on the successes we saw from the 2023 reforms to bring real relief to Iowa property taxpayers, reform to the property tax system, and make property taxes more predictable for businesses and local governments. This proposal is the biggest overhaul in property taxes in decades. At this time, it is estimated to provide a $426 million cut in property taxes for Iowans, implement a revenue restriction to ensure relief, and deliver additional relief for Iowa’s veterans and senior citizens.

The bill phases out the antiquated rollback system for residential, commercial, and industrial property over five years. This system was put in years ago but has now only made property taxes unpredictable and complicated. By eliminating the rollback, along with lowering levy rates, limiting revenue increases and moving from tax credits to exemptions, the bill provides more stability for local governments and businesses and makes property taxes simpler and fairer for everyone.

When I talk to constituents at home, property taxes are the number one thing on their mind. The bill passed in 2023 accomplished a lot and worked well at starting the process of true property tax reform. While that reform addressed the immediate concerns of Iowa homeowners, this bill is a major step forward in providing real relief for Iowans and making sure our state is a great place for those looking to call Iowa home. We are hoping to hear from interested parties as this bill moves forward, and I am looking forward to the conversations on how we can ensure property taxpayers are being prioritized.