WASHINGTON, D.C. – President Donald Trump hosted the first-ever White House Digital Asset Summit Friday afternoon, and a dark corner of the financial World took a big step out of the shadows as a Strategic Bitcoin Reserve and Digital Asset Stockpile was established, along with America as the “crypto capital of the world”.

WASHINGTON, D.C. – President Donald Trump hosted the first-ever White House Digital Asset Summit Friday afternoon, and a dark corner of the financial World took a big step out of the shadows as a Strategic Bitcoin Reserve and Digital Asset Stockpile was established, along with America as the “crypto capital of the world”.

“Welcome to the first-ever White House Digital Asset Summit,” President Trump said Friday at the ceremony. “Last year, I promised to make America the Bitcoin superpower of the world, and we’re taking historic action to deliver on that promise.”

Fact Sheet: President Donald J. Trump Establishes the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile

President Donald J. Trump signed an Executive Order to thunderous applause, establishing a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, allegedly positioning the United States as a leader among nations in government digital asset strategy.

The Order creates a Strategic Bitcoin Reserve that will treat bitcoin as a reserve asset.

The Strategic Bitcoin Reserve will be capitalized with bitcoin owned by the Department of Treasury that was forfeited as part of criminal or civil asset forfeiture proceedings. Other agencies will evaluate their legal authority to transfer any bitcoin owned by those agencies to the Strategic Bitcoin Reserve.

The United States will not sell bitcoin deposited into this Strategic Bitcoin Reserve, which will be maintained as a store of reserve assets.

The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies impose no incremental costs on American taxpayers.

It also established a U.S. Digital Asset Stockpile, consisting of digital assets other than bitcoin owned by the Department of Treasury that was forfeited in criminal or civil asset forfeiture proceedings.

The government will not acquire additional assets for the U.S. Digital Asset Stockpile beyond those obtained through forfeiture proceedings.

The Secretary of the Treasury may determine strategies for responsible stewardship, including potential sales from the U.S. Digital Asset Stockpile.

Agencies must provide a full accounting of their digital asset holdings to the Secretary of the Treasury and the President’s Working Group on Digital Asset Markets.

This Order ensures a strategic approach to managing digital assets under U.S. control.

ADDRESSING A CRYPTO MANAGEMENT GAP:

Bitcoin, the original cryptocurrency, is referred to as “digital gold” because of its scarcity and security, having never been hacked.

With a fixed supply of 21 million coins, there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve.

The United States currently holds a significant amount of bitcoin but has not maximized its strategic position as a unique store of value in the global financial system.

Premature sales of bitcoin have already cost U.S. taxpayers over $17 billion.

The Executive Order begins to resolve the current disjointed handling of cryptocurrencies seized through forfeiture by, and scattered across, various Federal agencies.

Currently, no clear policy exists for managing these assets, leading to a lack of accountability and inadequate exploration of options to centralize, secure, or maximize their value.

Taking affirmative steps to centralize ownership, control, and management of these assets within the Federal government will ensure proper oversight, accurate tracking, and a cohesive approach to managing the government’s cryptocurrency holdings.

This move harnesses the power of digital assets for national prosperity, rather than letting them languish in limbo.

DELIVERING ON PLEDGE TO MAKE AMERICA THE CRYPTO CAPITAL OF THE WORLD: President Trump is fulfilling his promise to position America as the global leader in cryptocurrency.

President Trump promised to make the United States the “crypto capital of the world,” emphasizing the need to embrace digital assets to drive economic growth and technological leadership.

In his first week in office, President Trump signed an Executive Order to promote United States leadership in digital assets such as cryptocurrency.

President Trump has consistently advocated for a forward-thinking approach to crypto, stating: “I am very positive and open minded to cryptocurrency companies, and all things related to this new and burgeoning industry. Our country must be the leader in the field.”

President Trump promised to create a Strategic Bitcoin Reserve and a Digital Assets Stockpile.

President Trump appointed a “crypto czar” and is hosting the first-ever crypto summit at the White House, just a few of the many ways this Administration is demonstrating its strong commitment to this digital asset.

https://x.com/WhiteHouse/status/1898112552900403569

ESTABLISHMENT OF THE STRATEGIC BITCOIN RESERVE AND UNITED STATES DIGITAL ASSET STOCKPILE

By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered:

Section 1. Background. Bitcoin is the original cryptocurrency. The Bitcoin protocol permanently caps the total supply of bitcoin (BTC) at 21 million coins, and has never been hacked. As a result of its scarcity and security, Bitcoin is often referred to as “digital gold”. Because there is a fixed supply of BTC, there is a strategic advantage to being among the first nations to create a strategic bitcoin reserve. The United States Government currently holds a significant amount of BTC, but has not implemented a policy to maximize BTC’s strategic position as a unique store of value in the global financial system. Just as it is in our country’s interest to thoughtfully manage national ownership and control of any other resource, our Nation must harness, not limit, the power of digital assets for our prosperity.

Sec. 2. Policy. It is the policy of the United States to establish a Strategic Bitcoin Reserve. It is further the policy of the United States to establish a United States Digital Asset Stockpile that can serve as a secure account for orderly and strategic management of the United States’ other digital asset holdings.

Sec. 3. Creation and Administration of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.

(a) The Secretary of the Treasury shall establish an office to administer and maintain control of custodial accounts collectively known as the “Strategic Bitcoin Reserve,” capitalized with all BTC held by the Department of the Treasury that was finally forfeited as part of criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty imposed by any executive department or agency (agency) and that is not needed to satisfy requirements under 31 U.S.C. 9705 or released pursuant to subsection (d) of this section (Government BTC). Within 30 days of the date of this order, each agency shall review its authorities to transfer any Government BTC held by it to the Strategic Bitcoin Reserve and shall submit a report reflecting the result of that review to the Secretary of the Treasury. Government BTC deposited into the Strategic Bitcoin Reserve shall not be sold and shall be maintained as reserve assets of the United States utilized to meet governmental objectives in accordance with applicable law.

(b) The Secretary of the Treasury shall establish an office to administer and maintain control of custodial accounts collectively known as the “United States Digital Asset Stockpile,” capitalized with all digital assets owned by the Department of the Treasury, other than BTC, that were finally forfeited as part of criminal or civil asset forfeiture proceedings and that are not needed to satisfy requirements under 31 U.S.C. 9705 or released pursuant to subsection (d) of this section (Stockpile Assets). Within 30 days of the date of this order, each agency shall review its authorities to transfer any Stockpile Assets held by it to the United States Digital Asset Stockpile and shall submit a report reflecting the result of that review to the Secretary of the Treasury. The Secretary of the Treasury shall determine strategies for responsible stewardship of the United States Digital Asset Stockpile in accordance with applicable law.

(c) The Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers. However, the United States Government shall not acquire additional Stockpile Assets other than in connection with criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty imposed by any agency without further executive or legislative action.

(d) “Government Digital Assets” means all Government BTC and all Stockpile Assets. The head of each agency shall not sell or otherwise dispose of any Government Digital Assets, except in connection with the Secretary of the Treasury’s exercise of his lawful authority and responsible stewardship of the United States Digital Asset Stockpile pursuant to subsection (b) of this section, or pursuant to an order from a court of competent jurisdiction, as required by law, or in cases where the Attorney General or other relevant agency head determines that the Government Digital Assets (or the proceeds from the sale or disposition thereof) can and should:

(i) be returned to identifiable and verifiable victims of crime;

(ii) be used for law enforcement operations;

(iii) be equitably shared with State and local law enforcement partners; or

(iv) be released to satisfy requirements under 31 U.S.C. 9705, 28 U.S.C. 524(c), 18 U.S.C. 981, or 21 U.S.C. 881.

(e) Within 60 days of the date of this order, the Secretary of the Treasury shall deliver an evaluation of the legal and investment considerations for establishing and managing the Strategic Bitcoin Reserve and United States Digital Asset Stockpile going forward, including the accounts in which the Strategic Bitcoin Reserve and United States Digital Asset Stockpile should be located and the need for any legislation to operationalize any aspect of this order or the proper management and administration of such accounts.

Sec. 4. Accounting. Within 30 days of the date of this order, the head of each agency shall provide the Secretary of the Treasury and the President’s Working Group on Digital Asset Markets with a full accounting of all Government Digital Assets in such agency’s possession, including any information regarding the custodial accounts in which such Government Digital Assets are currently held that would be necessary to facilitate a transfer of the Government Digital Assets to the Strategic Bitcoin Reserve or the United States Digital Asset Stockpile. If such agency holds no Government Digital Assets, such agency shall confirm such fact to the Secretary of the Treasury and the President’s Working Group on Digital Asset Markets within 30 days of the date of this order.

Sec. 5. General Provisions. (a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

THE WHITE HOUSE,

March 6, 2025

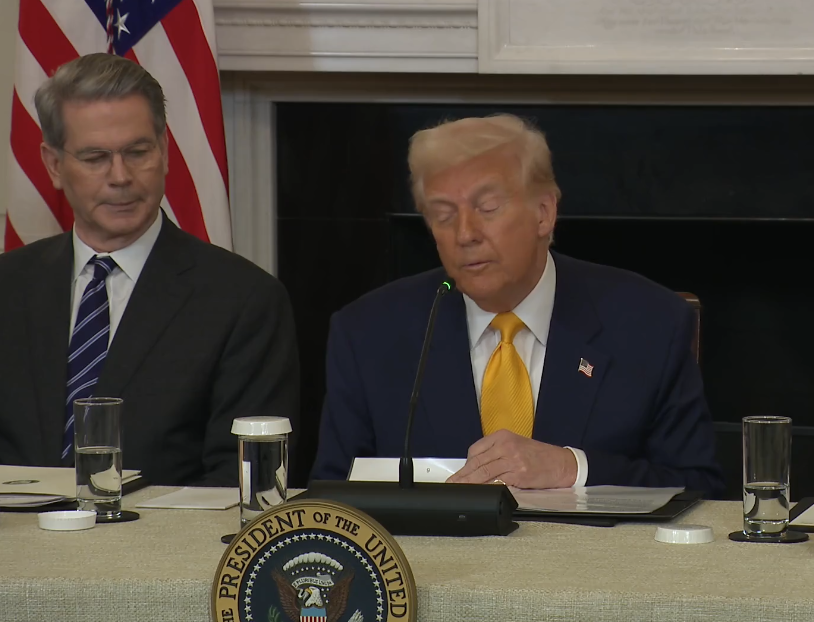

(TOP PHOTO via the White House of Treasury Secretary Scott Bessent (left) with President Donald Trump.)

3 thoughts on “Crypto goes mainstream in America: Trump hosts Digital Asset Summit, establishes Strategic Bitcoin Reserve”

All MAGAs should start investing your savings today. I know it won’t be much more than $50 but every little bit will help mr trump and we know you love to help him. If all 72 million people who voted for me put in $50, that is $36 million I will make. Don’t worry about the risk. I will take care of it.

Hopefully this helps you out.

Keep investing in the Yuan, Larry