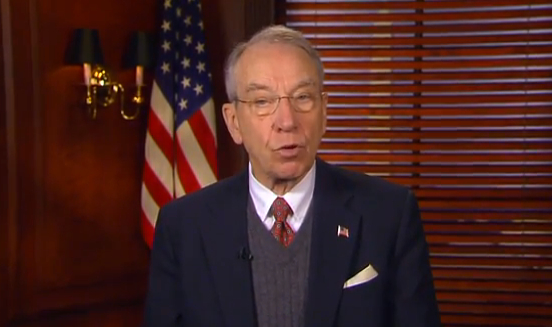

From Senator Charles Grassley –

The Washington Post quotes Nina Olson, the national taxpayer advocate, as saying the IRS does a good job collecting back taxes that are due and owed, so the use of private contractors to collect those debts is unnecessary. However, the non-partisan congressional Joint Committee on Taxation, the official estimator of tax provisions, says the current proposal in the tax extenders bill to engage private contractors to collect tax debts would generate $2.4 billion over ten years for the U.S. treasury. Sen. Chuck Grassley, a senior member and former chairman and ranking member of the Finance Committee, made the following comment on Olson’s comments.

“The use of private contractors is meant to get at legitimate tax debts that the IRS can’t or won’t collect on its own. These contractors are set up to do the work. They aren’t meant to detract from the IRS’ work. They’re meant to make up for what the IRS can’t do, while saving money. And there’s no getting around the estimate from the Joint Committee on Taxation that the current proposal would raise $2.4 billion over 10 years. That says the proposal would work, as intended. Collecting tax debt is only fair to all taxpayers who pay what they owe.”

The Joint Committee on Taxation score of the current tax extenders bill including the private contractor tax collection proposal is available here (see p. 4, subtitle C, revenue provisions, line number 4. Reform of rules related to qualified tax collection contracts $2.384 billion).

TIGTA and GAO studies are available here and here.