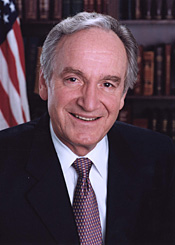

WASHINGTON, D.C. — At a Newsmaker press conference at the National Press Club today, U.S. Senator Tom Harkin, Chairman of the Senate Health, Education, Labor, and Pensions (HELP) Committee, unveiled bold new legislation to tackle the growing retirement crisis and rebuild the private pension system. Harkin’s legislation, the Universal, Secure, and Adaptable (USA) Retirement Funds Act of 2014, comes at a time when the retirement income deficit has reached at least $6.6 trillion, leaving many Americans vastly unprepared for retirement. Seventy-five million working Americans do not have a retirement plan, and half of all Americans have less than $10,000 in savings.

“Our country is facing a growing retirement crisis, and it’s only going to get worse unless we take action,”Harkin said. “The USA Retirement Funds Act offers a common-sense solution to the retirement crisis by giving the 75 million people without a retirement plan at the workplace the opportunity to earn a safe, portable, and secure pension benefit for life. USA Retirement Funds would be 21st century retirement plans, run entirely by the private sector, that drastically reduce costs through professional management and risk sharing. Simply put, giving people without access to a quality employer-provided plan the opportunity to earn a retirement benefit would help ensure every American enjoys their golden years with the dignity and financial independence they deserve.

“The USA Retirement Funds Act is particularly good for small business owners. It would allow them to offer more competitive benefits to their employees while at the same time relieving them of the burden of managing a pension plan themselves.” Harkin added. “It is important to note that the USA Retirement Funds Act would also be good for the economy. It would significantly increase retirement savings, and all of that savings would be invested right back into the economy, fueling new growth and job creation.”

Harkin’s legislation would create a new type of privately-run retirement plan that combines the advantages of traditional pensions—including lifetime income benefits and pooled, professional management—with the portability and ease for employers of a 401(k). The key features of USA Retirement Funds include:

- Universal Coverage: USA Retirement Funds would be available to everyone, including the more than 61 million people without access to a workplace retirement plan and the 14.5 million people who are self-employed.

- Automatic Enrollment: Employees would be automatically enrolled at a rate of 6 percent per year, but could choose to raise, lower, or stop their contributions.

- Secure Lifetime Income: Benefits would be paid monthly for life, and participants would be shielded from market volatility and other risks.

- Lower Costs: Pooled, professional management and risk sharing will reduce the cost of retirement by up to 50 percent.

- Portability: People would be able to take their benefit with them as they change employers.

- Simple and Easy for Businesses: Small businesses can easily participate and would not have to take on risk or undue administrative burden.

Public support is especially strong for retirement system reform, with numerous studies and polls showing that Americans are concerned about retirement security and want access to better options. Researchby the National Institute on Retirement Security (NIRS) found that 85 percent of Americans are worried about their retirement prospects, and 84 percent say that all Americans should have access to a pension to be self-sufficient in retirement. The study also found that Millennials – the youngest generation of workers – overwhelmingly agree (95 percent) that reforms are needed to the current retirement system, and 90 percent say lawmakers need to make this a high priority.

Just today, the Center for American Progress Action Fund released a polling briefshowing that Americans are deeply worried about their retirement security and believe retirement reform should be a much higher priority in Washington. Polling data summarizedby the Pensions Right Center found that 84 percent are concerned that current economic conditions are impacting their ability to achieve a secure retirement, and two-thirds cite saving for retirement as their biggest financial worry. Furthermore, small businesses are also behind reform, with an American Sustainable Business Council poll showing 70 percentof small business owners saying that a lack of retirement security undermines the confidence and willingness to spend among older Americans.

Joining Harkin to unveil the USA Retirement Funds Act were Mary Kay Henry, President of the Service Employees International Union (SEIU), and Denise Bowyer, Vice President at the American Income Life Insurance Company. Henry discussed how the legislation would give middle-class families the opportunity to earn a secure retirement benefit that they can take with them as they change jobs and that they cannot outlive, while Bowyer outlined how the bill would also make it simple for employers to offer a benefit without having to take on risk or administrative burden.

“SEIU firmly believes that all Americans should be able to enjoy a dignified retirement after a lifetime of hard work and playing by the rules,” Henry said. “We think Senator Harkin’s bill will fill a critical need for the half of the working population who have no access to a retirement plan at work.”

“Senator Harkin’s USA Retirement Funds Act fills in many blanks now left by the IRA or company-sponsored retirement plan options with an approach that is easy and low-cost for the many employers who want to offer a plan but feel that existing programs are too costly,” Bowyer said. “It also importantly begins to address a critical problem facing business leaders today: the prospect of an aging customer base with limited means. Since many American workers are not saving enough for their retirement, Senator Harkin’s call for an automatic enrollment and deposit system via payroll deduction is a smart move. Businesses thrive only when there are enough customers with enough income to afford goods and services. This plan should give every business leader more confidence in the future strength of our economy.”

In additional to establishing USA Retirement Funds, the Act would make it easier for small employers to offer pooled retirement plans, encourage plan sponsors to incorporate lifetime income solutions into their defined contribution plans, provide increased fiduciary and other protections for plan participants, simplify the administration of defined benefit pension plans, and improve the pension insurance system.

A bill snapshot, two-page summary, and a list of frequently asked questions are available online.

The best way to save a private pention plan is to stop forcing the private to pay for the public!!!

Let them fund their own just like everybody else has to.

Government programs will continue to rape our income until all we have left is approximatley 30% of our earned income. Better get used to it as SOCIALISM is rearing it’s ugly head and will continue to do so. And yes folks, Medicare and Social Security benefits will be cut – especially now with Affordable Care Act in “messed up swing”. Seniors need to brace themselves for reduced Medicare benefits/limited healthcare!! It’s just around the corner. Ask any healthcare professional and they can give you a brief descriptioin of what lies ahead for America, unlike the lies told by the White House, and you will be in for an sore eye opener! Better yet, ask a Canadian what they think of their Socialized Medicine program and how long it takes to get an appointment to see a doctor, and the limited care they have access to. Why do you think so many of them come to the U.S. for healthcare??

As far as the “pension/retirement fund” programs go, well look at the auto industry and see all the failure there. And the U.S. Postal System is broke as well partly due to enormous retirement benefits! No company can sustain such outragous retirment programs and be financially successful. As proven by the government bail out of GM, etc. ! And then there is the teachers union retirement program – look how it has increased the education system costs in this country. Our children -sure as hell- are not any smarter today then they were in the 1970’s when that union was created. Ever wonder how much their retirement program costs the taxpayer? Same goes for public/government employees. Private sector employees have to pay into their own retirement program or purchase an IRA – none of them taxpayer funded!

Congress can get lifetime benefits for serving only one term – this is outrageous! All the more need for term limits in D.C. and reduced benefits for those people.

BRACE YOURSELF AMERICA – your take home pay will continue to shrink until you only take home 30% of what you earned! Actually it could go to as little as 25% for take-home pay = AHHHH SOCIALISM

So you pay 6% to SS -6% for a private plan plus 400 dollars per month for obamadon’t care which all goes to the government to more or less throw in the general fund – with city/county /state and federal taxes that leaves us with what 50% of our hard earned money?

Great concept but:

Problem with this is, the Federal Government is involved. With the Feds involved the money really isn’t our own. History teaches us that any time they want to take the money and use it for something else the Government can and DOES!

Medicare has recently been raided without permission by the American People to take 700 Billion Dollars from it and put it into another program. Now we see the beginning of reduced medical benefits to Senior Citizens.

Social Security money has been taken from it’s trust fund to build the interstate highway system, (that was under President Eisenhower) and never paid back. Now Social Security is on track to go bankrupt.

****2013 OFFICIAL GOVERNMENT SUMMARY OF THE 2013 ANNUAL REPORTS, Social Security and Medicare Boards of Trustees****

http://www.ssa.gov/oact/trsum/

Unless there is a Constitutional Amendment that prohibits the Federal Government from taking the money, this too is another Government sham.