The following is a legislative update from Republican State Rep. Shannon Latham, representing portions of Franklin, Hamilton, Story and Wright counties in Iowa House District 55:

Iowa House Holds First Debate in Week 2

Week 2 of the 2026 Iowa legislative session was filled with constituent visits, subcommittee and committee meetings, plus our first debate of the year. The legislature didn’t meet on Monday, Jan. 16, to observe Martin Luther King, Jr. Day. Although it was a short work week, a lot happened.

How a Bill Becomes a Law

Because my weekly newsletter highlights my subcommittee and committee work, I’m providing a summary of the lawmaking process. Legislation is proposed by many different groups, including legislators, lobbyists, constituents and the governor. The proposed bill is sent to the non-partisan Legislative Services Agency (LSA) for bill drafting.

Once the proposed bill is written in the proper legal language, it gets filed by the sponsoring legislator and assigned to one of 20 Iowa House committees. The committee chairperson decides whether to assign the bill to a three-person subcommittee for consideration. That subcommittee holds a public meeting for input and determines whether the bill moves to the full committee for consideration.

If the committee chair brings it forward – and the bill gains the majority vote in committee – it becomes eligible for a floor vote. The Majority Leader decides if and when it comes before the Iowa House of Representatives for debate and a vote.

If it passes the House, the bill is messaged to the Senate and this process is repeated. If the bill passes with the exact language, it goes to the Governor for her signature. If the Senate amends the House language, then it returns to the House for reconsideration. A bill must pass both chambers in the exact form before the Governor can sign it into law.

HF 2104 – Protecting Landowners from Eminent Domain Abuse

After Gov. Reynolds vetoed the bill that passed both chambers last session, the Iowa House responded with a simplified bill. House File (HF) 2104 prohibits the use of eminent domain for the purpose of carbon dioxide pipelines. This bill ensures that companies must negotiate fairly with Iowans instead of using the heavy hand of the government to build. HF 2104 passed with 54 Republicans – including me – and 10 Democrats voting “aye.” The Senate is expected to pass its own version as early as next week, so a compromise will be needed to get protections for landowner rights to the Governor’s desk.

HR 102 – Recognizing the 2025 Iowa Pork Queen

Rep. Chad Ingels and I honored the 2025 Iowa Pork Queen, Amanda Ostrem, by introducing House Resolution 102. Amanda grew up on a farm near Stanhope in Hamilton County, where her family remains involved in pork production. She served on the Iowa Pork Youth Leadership Team. Through her studies in Agricultural Communication at Iowa State University, she has further developed a passion for agricultural advocacy. Amanda is currently exploring her interest in agricultural policy by working in the Iowa House of Representatives as a legislative clerk for Rep. Chad Ingels and me.

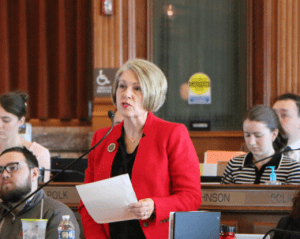

(TOP PHOTO: Recognizing the 2025 Iowa Pork Queen, Amanda Ostrem, via Latham’s office.)

HF 2094 – Improving Hospitalization Facilities

Hospitals are designed for acute, short-term care. However, sometimes people remain hospitalized longer because there is nowhere safe for them to go. This is stressful for all involved parties, plus it’s inefficient for the entire system. After hearing from North Iowa families facing this situation, I worked with Rep. Ann Meyer to introduce House File 2094. This bill requires the Iowa Department of Health & Human Services (Iowa HHS) to increase the number of adult and youth inpatient psychiatric beds at the state’s mental health institutions. The bill has a subcommittee meeting scheduled for Tuesday, Jan. 27.

HSB 596 – Property Tax Relief

Iowa House Republicans this week released House Study Bill 596, a property tax proposal. The objective of this bill is to bring simplicity, transparency, and relief to taxpayers. The key difference in this proposal from others is the exemption on the first $25,000 of the assessed value of every residential property, delivering immediate tax relief to every homeowner in Iowa.