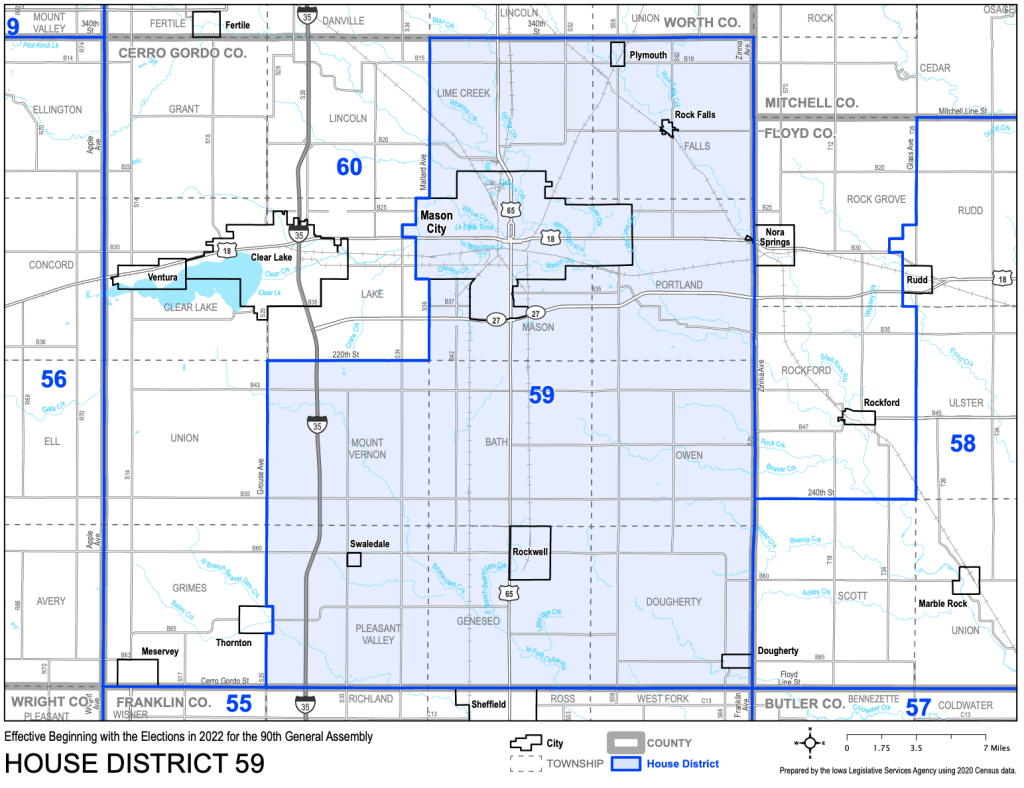

The following is a legislative update from State Representative Christian Hermanson (R–Mason City), representing District 59 – the eastern half of Cerro Gordo county – in the Iowa Legislature:

Week 2 of the 2026 session is behind us – AT-EASE North Iowa!

Two issues keep coming up in North Iowa: getting real property tax relief and protecting private property rights. Here is where things stand this week.

Property taxes: Three proposals are on the table

Property tax reform is moving fast. The House, Senate, and Governor all have proposals. We all share the same goal: meaningful relief for Iowans. Where we differ is the approach.

One important point that often gets missed: the State of Iowa does not see a dime of your property tax dollars. Property taxes are set, levied, and spent locally. Your county, city, school district, and other local taxing authorities establish budgets, set levies, and decide how those dollars are used.

That means state policy can help by putting guardrails in place, improving transparency, and encouraging cost-saving cooperation. But lasting relief depends on local decision-making. If you want property taxes under control, your local elected officials need to hear clearly and consistently from you!

The House plan

The House Republican proposal focuses on holding the line on local property tax growth and providing across-the-board homeowner relief.

Key points:

2% cap on property tax revenue growth for most local governments

Exceptions include new construction, schools, and debt

$25,000 residential exemption for all homeowners (after rollback)

Clearer property tax notices so you can better see where the money goes

Encourages shared services and consolidation to reduce costs

Requires 60% voter approval for bonds repaid with property taxes

The Senate plan

The Senate proposal uses a different structure for caps and emphasizes larger homestead relief.

Key points:

Property tax caps tied to inflation instead of a flat number

Phases out the rollback system and moves toward a 50% homestead exemption

Proposal to eliminate most property taxes for homeowners age 60+ later in the decade if they have paid off their mortgage

Discusses potential replacement revenue options such as local option sales tax adjustments and indexing the gas tax

The Governor’s plan:

The Governor’s proposal includes caps, targeted senior relief, and structural reforms.

Key points:

2% cap on local revenue growth, with new construction allowed and key exceptions

Freezes property taxes for homeowners age 65+ with home values $350,000 or less

Changes assessments from every two years to every three years

TIF reforms to limit long-term impacts on local tax bases

Creates first home savings accounts

Creates state grants to support consolidation and shared services

Proposes making the county auditor, treasurer, and recorder appointed rather than elected

The big differences to watch

Revenue caps: House and Governor use a flat 2%; Senate ties caps to inflation

Homeowner relief: House provides a flat exemption; Senate moves toward a larger homestead exemption; Governor targets seniors

Gas tax: only part of the Senate discussion

County offices: only part of the Governor’s proposal

My bottom line

Iowans want a system that is simpler, fairer, and predictable. I agree. My focus is:

Real relief for homeowners and families

Responsible and reasonable limits on property tax growth

Transparency so taxpayers can see where their dollars go

Protecting services that communities rely on, while reducing waste and redundancy

I will keep you updated as the final package takes shape.

Protecting property rights: Eminent domain and HF 2104

This week, the Iowa House passed House File 2104. The bill focuses on one narrow but important question: Should a private company be able to use eminent domain to take land for a carbon dioxide pipeline if a landowner does not agree?

HF 2104 says NO. It does not ban pipelines in Iowa. It does not stop energy or infrastructure projects. It simply requires developers to secure voluntary easements from landowners, instead of using eminent domain to force an agreement.

Why this matters:

A pipeline easement is not a short-term inconvenience. It can affect soil, drainage, crop production, and future land use for decades.

Eminent domain is a powerful tool that should be used for clear public necessities, not as a shortcut for private development.

Iowa can support economic development while still respecting the constitutional rights of landowners.

I supported this bill because it should be the rare exception where private property is taken without consent for a private project.

HF 2104 now moves to the Senate for consideration.

(TOP PHOTO of Hermanson (center) with Iowa vets, via Hermanson’s office.)