In healthcare, financial performance is rarely determined by a single factor. Instead, it is shaped by how effectively a practice manages dozens of interconnected billing and revenue cycle activities. Without clear measurement, inefficiencies remain hidden, revenue leaks persist, and decision-making relies on assumptions rather than data.

This is where medical billing KPIs (Key Performance Indicators) become essential. KPIs provide measurable insight into how well a practice’s billing processes are performing and where improvements are needed. For healthcare leaders, understanding and tracking the right KPIs enables proactive management, stronger cash flow, and long-term financial stability.

This article outlines the most important medical billing KPIs every healthcare practice should track, explains what each metric reveals, and shows how KPI-driven oversight improves financial performance.

Why Medical Billing KPIs Matter

Medical billing KPIs translate complex billing activity into actionable insight. They help practices:

- Identify revenue cycle bottlenecks

- Measure billing efficiency

- Detect compliance risks

- Track improvement over time

- Support data-driven decisions

Without KPIs, practices may be busy—but not necessarily effective.

KPI #1: Days in Accounts Receivable (AR)

Days in AR measures the average number of days it takes to collect payment after services are rendered.

Why It Matters

- Indicates cash flow health

- Highlights collection delays

- Reflects billing efficiency

Target Benchmark

Typically 30–45 days, depending on payer mix.

High AR days signal issues in claims submission, follow-up, or denial management.

KPI #2: Clean Claim Rate

The clean claim rate represents the percentage of claims accepted by payers on first submission without errors.

Why It Matters

- Measures billing accuracy

- Predicts reimbursement speed

- Reduces rework and administrative cost

Target Benchmark

Above 95% for most practices.

Low clean claim rates indicate problems with registration, coding, or claim validation.

KPI #3: Denial Rate

The denial rate tracks the percentage of claims denied by payers.

Why It Matters

- Identifies revenue leakage

- Highlights process breakdowns

- Signals compliance risk

Target Benchmark

Below 5%.

Tracking denial reasons is as important as tracking the rate itself.

KPI #4: First-Pass Resolution Rate

This KPI measures the percentage of claims paid in full on first submission.

Why It Matters

- Reflects end-to-end billing effectiveness

- Reduces administrative burden

- Improves cash flow predictability

A high first-pass resolution rate indicates strong front-end and back-end alignment.

KPI #5: Net Collection Rate

Net collection rate measures how much of the allowed amount is actually collected after contractual adjustments.

Why It Matters

- Reveals true revenue performance

- Accounts for payer contracts

- Identifies underpayments

Target Benchmark

95% or higher.

A low net collection rate suggests missed follow-up or payment posting errors.

KPI #6: Gross Collection Rate

The gross collection rate compares total payments received to total charges billed.

Why It Matters

- Provides a high-level performance snapshot

- Helps identify major revenue issues

While useful, this KPI should be interpreted alongside net collection rate for accuracy.

KPI #7: Denial Resolution Rate

This metric tracks the percentage of denied claims that are successfully appealed and paid.

Why It Matters

- Measures effectiveness of denial management

- Protects earned revenue

Low resolution rates indicate missed opportunities for recovery.

KPI #8: Average Reimbursement per Encounter

This KPI calculates the average payment received per patient encounter.

Why It Matters

- Highlights payer performance

- Identifies service-line profitability

- Supports contract evaluation

Tracking trends helps practices optimize payer mix and service offerings.

KPI #9: Charge Lag

Charge lag measures the time between service delivery and charge entry.

Why It Matters

- Affects timely filing

- Delays reimbursement

- Signals workflow inefficiencies

Reducing charge lag improves overall revenue cycle speed.

KPI #10: Payment Posting Lag

Payment posting lag tracks how quickly payments are posted after receipt.

Why It Matters

- Supports accurate financial reporting

- Enables faster follow-up on underpayments

Delayed posting obscures performance and slows collections.

KPI #11: Patient Collection Rate

With rising patient responsibility, tracking patient collections is increasingly important.

Why It Matters

- Reflects effectiveness of patient billing

- Impacts cash flow

- Influences patient satisfaction

Clear communication and flexible payment options improve this metric.

KPI #12: Bad Debt Rate

The bad debt rate measures the percentage of revenue written off as uncollectible.

Why It Matters

- Highlights front-end financial screening issues

- Signals patient billing challenges

Reducing bad debt requires improved eligibility verification and patient engagement.

KPI #13: Cost to Collect

This KPI measures the cost incurred to collect revenue.

Why It Matters

- Evaluates billing efficiency

- Supports staffing and outsourcing decisions

Lower cost to collect improves overall profitability.

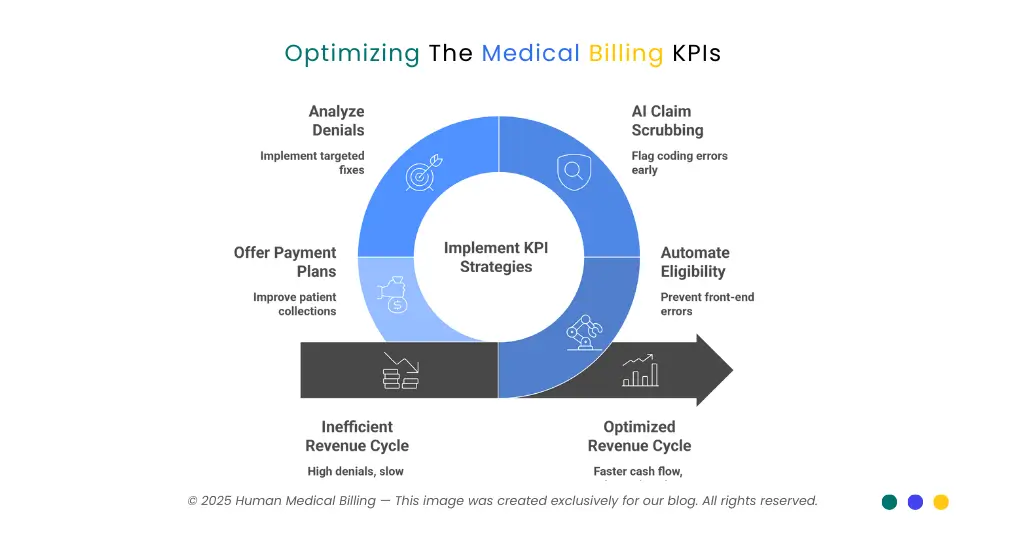

How to Use KPIs Effectively

Tracking KPIs alone is not enough. Practices must:

- Review metrics regularly

- Compare against benchmarks

- Investigate root causes

- Implement corrective actions

KPIs should drive improvement—not just reporting.

Common KPI Tracking Mistakes

Tracking Too Many Metrics

Focus on KPIs that align with financial goals.

Ignoring Trends

Month-to-month trends reveal more than isolated data points.

Failing to Act

KPIs lose value if insights are not applied.

Role of Technology in KPI Tracking

Modern billing systems and analytics platforms:

- Automate KPI reporting

- Provide real-time dashboards

- Enable data-driven decisions

Technology enhances visibility, but leadership must interpret and act on the data.

KPI Ownership and Accountability

Assigning responsibility for KPI performance ensures:

- Consistent monitoring

- Timely corrective action

- Continuous improvement

Clear ownership turns metrics into outcomes.

In-House vs Outsourced KPI Management

Some practices manage KPIs internally, while others rely on external partners.

Outsourced billing partners often provide:

- Advanced analytics

- Industry benchmarks

- Dedicated performance oversight

The right approach depends on resources and complexity.

Why KPI-Driven Management Supports Growth

Practices that manage by KPIs:

- Detect issues early

- Improve cash flow stability

- Support strategic planning

- Scale with confidence

KPIs transform billing from a reactive function into a strategic asset.

Conclusion

Medical billing KPIs provide the insight healthcare practices need to manage financial performance effectively. By tracking metrics such as days in AR, clean claim rate, denial rate, and net collection rate, practices gain visibility into where revenue is earned, delayed, or lost.

KPI-driven management enables proactive decision-making, improved cash flow, and sustainable growth. For healthcare organizations seeking structured performance oversight and improvement, medical billing company help practices implement KPI-focused billing strategies—ensuring financial data translates into actionable insight, operational control, and long-term success.