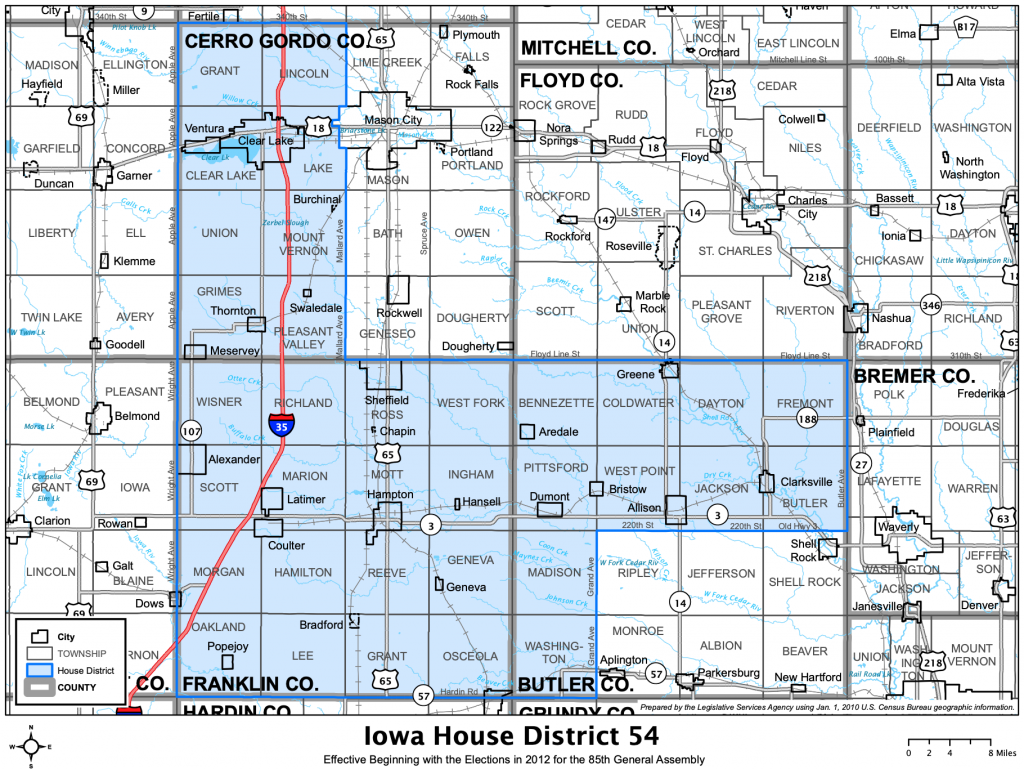

The following is a legislative update from Republican State Rep. Shannon Latham, representing portions of Franklin, Butler and Cerro Gordo counties in Iowa House District 54:

The third week of the 2022 legislative session was again filled with subcommittee and full committee meetings, as well as constituent visits.

At least 75 subcommittee meetings were held this week in the Iowa House! Each proposed bill must pass through a subcommittee before it gets considered by one of the 20 committees in the Iowa House of Representatives. I serve as vice chair of Appropriations. I also serve on the Agriculture, Natural Resources, and Information Technology Committees. Three subcommittee members work to understand a bill and collect public comments; at least 2/3 of the subcommittee members must recommend passage before a bill may be considered by the full committee. After a subcommittee meeting has been held, then the bill gets discussed during a committee meeting. If it is passed by the committee, then it is placed on the House Debate Calendar.

In last week’s newsletter, I wrote that I was assigned to serve as subcommittee chair on House Study Bill (HSB) 501. This bill would direct the three-member Revenue Estimating Conference (REC) to set an estimate for Sports Wagering Tax collections. This bill was passed Jan. 26 by the Appropriations Committee.

The Appropriations Committee on Jan. 26 also passed HF 2002 to appropriate general fund dollars to support christening and commissioning ceremonies of the new USS Iowa (SSN 797) submarine. These dollars also can be used to provide “Iowa touches” like gym and recreational equipment to the crew of 135 sailors.

This week I also served as subcommittee chair on House Study Bill (HSB) 501, which relates to the classification of property enrolled in the federal conservation reserve program. This bill was passed by the Agriculture Committee on Jan. 27.

Interested in following these bills as they work their way through the bill-making process? You can track any bill online at www.legis.iowa.gov/legislation

Governor’s Tax Proposal

I’ve received several calls and emails with questions about Governor Reynold’s Tax Proposal. Following is a summary of her proposed tax cuts:

-

Sale of Certain Qualified Stock (Net capital Gain Exclusion) – This provides an employee-owner with one lifetime election to exclude from income tax net capital gains from the sale or exchange of capital stock (ESOPs).

-

Retired Farmer Lease Income Exclusion – This provides that a retired farmer’s income from property rent is exempt from tax. To qualify, a farmer must have farmed for at least 10 years.

-

Retired Farmer Capital Gain Exclusion – This provides a single lifetime exclusion of capital gain on the sale of a retired farmer’s land or livestock.

-

Individual Income Tax Rates (years 2023-2025) – This strikes the tax brackets and rates that would go into effect in tax year 2023 and reduces them further in tax years 2023-2025.

-

Individual Income Tax – This provides for a flat tax of 4.0 percent on all taxable income, beginning in tax year 2026.

-

Corporate Income Tax Rates (Adjustments) – This provides for the corporate tax rates to be reduced based on a revue trigger. In a year when corporate tax revenue exceeds $700 million, the excess is used to reduce the corporate rates the following year.

-

Corporate Income Tax (Flat Rate) – When the corporate rates are reduced to a point where all rates equal 5.5 percent, the corporate tax rate is codified at a flat 5.5 percent.

-

Retirement Income – This provides that all retirement income would be excluded from tax.

Iowa House Republicans on Jan. 27 released its own tax plan that closely resembles the Governor’s proposed plan. Our plan also lowers taxes for all Iowans, so everyone pays a flat tax rate of 4 percent. Our plan makes retirement income exempt for all Iowans and creates a new income exemption option for retired farmers. However, our plan does not include a tax cut for corporations.

Constituent Visits

This week I had the pleasure of welcoming many of my agricultural friends to our state’s capitol. I met with members of the Iowa Soybean Board, including April Hemmes of Hampton and Casey Schlichting of Clear Lake. I also met with board members of the Agribusiness Association of Iowa (AAI) and learned about a non-profit affiliate organization that AAI launched in 2014 to specifically focus on soil nutrient issues. The Iowa Nutrient Research & Education Council (INREC) brings together business leaders who are manufacturers and suppliers of agronomy products with farm organization and commodity leaders into a single organization.