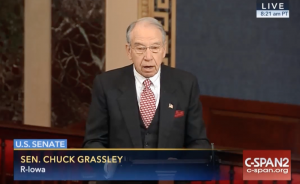

WASHINGTON – U.S. Sen. Chuck Grassley of Iowa, a senior member and former chairman of the Senate Finance Committee, which has jurisdiction over tax policy, voted for landmark tax reform legislation, which passed the United States Senate this morning. The legislation will likely be voted on by the House of Representatives later today before going to the President for his signature.

“This historic legislation makes good on a promise to deliver tax relief to Americans from every walk of life and income level. Its passage is good news for working families, U.S. jobs and industry and an economy that was stagnant for far too long. It will let Iowans keep more of their own money, so they can choose how best to spend what they’ve earned. Wages will also grow and jobs will return to our shores as a result of making American industry and workers more globally competitive.

“There have been some misconceptions about what this legislation does, which ideological opponents of lower taxes have helped sow. Iowans are understandably paying close attention to how they will be impacted. Iowans should rest assured they will begin seeing more in their take home pay almost immediately, and that will continue for years to come. This tax reform legislation lowers rates on every income level, and the progressivity of the tax code is maintained, ensuring that Iowans of all stripes will share the benefits of tax reform, and no one group is treated unfairly. As just one example, the average family of four with two children will see a tax cut of more than $2,000, and millions of lower-income Americans will be removed from the tax rolls entirely. That will make a real difference in the lives of so many hardworking Iowans.

“This bill also repeals the unfair and regressive Obamacare individual mandate tax. The bottom line is that this gives Iowans the freedom to make health care choices that work best for them, instead of being forced by the government to purchase an unaffordable product they either don’t want or don’t need. In 2015, more than 52,000 Iowans were required to pay the individual mandate tax, even though more than 80 percent of those who paid the tax made less than $50,000 a year. That’s a tax on middle-class families, and I’m glad to see it gone.”

Grassley successfully included taxpayer rights and corporate accountability measures in the tax reform legislation. Details of those two provisions are below. Grassley also helped protect the wind energy production tax credit, which he originally authored, and the student loan interest deduction. The wind energy production tax credit was modified in the House-passed version and the student loan interest deduction was eliminated.

As chairman of the Senate Finance Committee, Grassley previously led through Congress $2 trillion in bipartisan tax relief, leaving more money in workers’ pockets, reducing tax rates across the board and spurring economic growth and activity. Congress later made permanent the vast majority of the Grassley-led measures with significant bipartisan support.

Grassley-led provisions include:

To increase the time period in which taxpayers may seek to have proceeds from the sale of wrongfully levied property returned to them.

The IRS is authorized to levy on property to satisfy a tax debt in certain instances. While the IRS is authorized to return property at any time, it is only authorized to return the monetary proceeds from a sale for up to nine months from the date of the levy. Similarly, if a third party believes the property levied or seized belongs to him/her and not the person against whom the tax is assessed, the third party generally only has nine months from the time of the levy to bring an administrative wrongful-levy action to seek the return of monetary proceeds. In many cases the nine month period is insufficient for individuals and third parties to discover a wrongful or mistaken levy and seek to remedy it. Consistent with section 202 of S. 1793, the Taxpayer Bill of Rights Enhancement Act of 2017, this amendment would extend from nine months to two years the time period that individuals and third parties have to seek the return of proceeds on the sale of wrongfully levied property.

Government Settlement Transparency Act.

This amendment, consistent with S. 803, Government Settlement Transparency Act, would expand provisions relating to the nondeductibility of fines and penalties to prohibit a tax deduction for any amount paid or incurred to, or at the direction of, any governmental entity relating to the violation of any law or the investigation or inquiry into a potential violation of law. The bill exempts from such prohibition: (1) restitution or amounts paid to come into compliance with any law that was violated or otherwise involved in the investigation or inquiry, (2) amounts paid pursuant to a court order in a suit in which the governmental entity was not a party, and (3) amounts paid or incurred as taxes due.

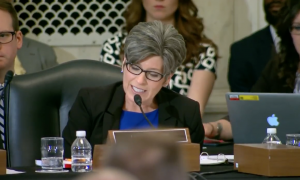

U.S. Senator Joni Ernst (R-IA) released the following statement after the Senate passed the final version of the Tax Cuts and Jobs Act which includes Senator Ernst’s SQUEAL Act.

“We are one step closer to helping hardworking, lower-and middle-income Iowans keep more of what they’ve earned. This tax reform package will also strengthen our economy and ensure job creators of all sizes see relief from an overly-complicated tax code.

“Additionally, I am thrilled that two of my proposals have been included in the final bill; the SQUEAL Act ensures legislators are offering up their own unnecessary tax break for living expenses in the Washington, D.C. area, and our bipartisan Investing in Opportunity Act will spur economic growth for many distressed rural communities across Iowa and the country.”

The landmark tax reform package now heads to the U.S. House of Representatives for a final vote, and then to the President’s desk for his signature.

Senator Ernst’s efforts included in the Tax Cuts and Jobs Act:

SQUEAL Act

The Investing in Opportunity Act

Thinly disguised gift to the Koch Bros and the other big GOP donors. The setup for an attempt next year to cut already inadequate social programs. The old fool Grassley never has given a damn about working & less fortunate Iowans but keeps getting elected over and over. Before Ernst came along, we at least had Harkin to cancel old Chuck out. Trump is simply disgusting, but the next in line, should Trump be impeached, is plain evil.

Great post Zeke/Bodacious/Nada Racist. Always good to hear from the left wing loons.

Says the right wing fascist.

You liberals love to blame somebody and twist the facts. The Koch Bros have nothing to do the Make America Great Again agenda. And who are the Koch Bros anyway? So they have some wealth. You all need to quit coveting!

As far as your made up blame game about “inadequate social programs” being cut, is bogus too. Free health care, medicare, and Social Security have all done more harm than good. None of those programs are COST EFFECTIVE! Even with that the Republicans are to scared to touch them with any kind of positive change so all your chicken little scare tactics aren’t valid either.

When are you people going to offering something positive for the working folks like President Trump has done? Why you want to foster dependency on the government is unreal. That is a dead end street for the poor folks for sure.

Why is it, that there is always a hatred in your agenda toward the people who make America good.

You conservatives love to blame somebody and twist the facts. The facts of this tax bill are that the 1% are making out like bandits when they really don’t need that help. All this tax bill does is give a bit of relief to the working class (but only for a short time because the cuts in state aid will cause states to raise taxes) and a lot of extra money to the billionaires of this country of which the President is one. This bill is a present to corporations.

Well said bodacious.

Also this tax bill will add 1.5 TRILLION dollars to the deficit.

Short term crumbs for the vast majority of Americans and huge dollars for the very wealthy & corporations.

More trickle down crap and adding a lot to the national debt.

This tax bill is pure bullshit.

“Comment Reader” is a typical clueless Trumpanzee.

The Koch brothers are deeply entrenched in the Republican party.

ALEC and the Tea Party are just some of their beneficiaries.

AS far as Trump goes, he is will go down as the worst President in US history.

If you believe that Trump is great and is for the average US citizen you are even dumber than you appear.

‘Send me the pillow you dream on, and darling I’ll always dream of you’. – Fantastic job!

Clyde….. lol

Thank you Republicans for letting me keep my own money. Tired of Dems raping us through taxes for years!! Hurray!!

I wrote Grassley once about my soc sec and he hog washed a answer and also said ” after all when I retire I only get $187,000 a yr and my health insurance supplied, poor baby

They need to feature more articles on Senator Joni Ernst.

SHEEP in wolves clothing,just kicking the can to 2025 your kids will pay for it.

What do you think the Democrats have been doing for decades? Your a fool.

President Trump has done more great thing for the American People his first year in office then any President ever.

His biggest and best accomplishment is the exposing how corrupt the main stream media is and how corrupt our government is.

We are so lied to by the media and politicians that the folks in the cheap seats have been kept in the dark, until now.

Tweet away Mr. President!

Watchdog, your credibility went down the toilet a few months back when you said that Trump had all the attributes of a Boy Scout “Trustworthy, Loyal, Helpful, Friendly, Courteous, Kind, Obedient, Cheerful, Thrifty, Brave, Clean, and Reverent”.

Trump will go down as the worst President in US history and currently holds the record for the worst approval rating of any President in their first year.

This tax bill is an abomination and you sheep are buying into it…literally & figuratively.

Thank you, thank you, thank you! All my life I watched my income and purchasing power decrease when Democrats were in charge. When Republicans were in charges my wages went up and my financial well being improved for my family.

After years of voting for Democrats and being told “they” were for the working man I finally quit voting for liberals and voted for conservative candidates.

Like it or not, Republicans not the Democrats have always improved America’s economy and made things better for all the folks.

Congratulations to President Trump and all those who voted to get some of the tax burden off our backs and bring down Corporate taxes so we can compete on the world stage and bring back our jobs and better wages.

This is a great day in America. Thank you again to all who took the heat from the lying Democrats. Thanks for MAKING AMERICA GREAT AGAIN!!!!

And they got that dammed ‘penalty tax’ for not having health insurance to go away. So people will start getting their ‘bonus’ refund check once a year again. Good job!

BAAA! follow the flock

Senator Ernst again proves she is a real go getter when it comes to getting the job done right. Joni’s so hot.