Whistleblower cases are increasingly prominent today, highlighting misconduct, fraud, and unethical behavior across sectors. These individuals play a crucial role in holding organizations accountable, yet their journeys often involve challenges and legal complexities. Navigating whistleblower protections and rights can be daunting. Understanding the legal framework and equipping oneself with the necessary knowledge is crucial. This article discusses various whistleblower cases and offers legal tips to help you know them better.

Whistleblower Laws and Protections

Whistleblower laws protect individuals who report illegal or unethical activities within a company or organization. These laws vary by jurisdiction but typically provide remedies for whistleblowers who suffer retaliation or discrimination due to their disclosures. The most well-known law in the United States is the False Claims Act (FCA), which allows individuals to file lawsuits on behalf of the government against companies that have defrauded federal programs.

Laws like the Sarbanes-Oxley Act (SOX) and the Dodd-Frank Act protect corporate whistleblowers. They safeguard employees who report financial fraud, accounting issues, or misconduct in public companies. Understanding these laws is crucial. Consulting experienced IRS/tax whistleblower lawyers can help in navigating the process. These legal professionals can help you understand your rights and guide you through the complexities of the legal system.

Common Types of Whistleblower Cases

There are various types of whistleblower cases that individuals may encounter, each with its own set of legal considerations. Some common types include:

- Healthcare Fraud: involves reporting fraudulent activities related to healthcare programs such as Medicare and Medicaid.

- Securities Fraud: This type of case involves exposing securities violations, such as insider trading or false statements made by a company to inflate its stock prices.

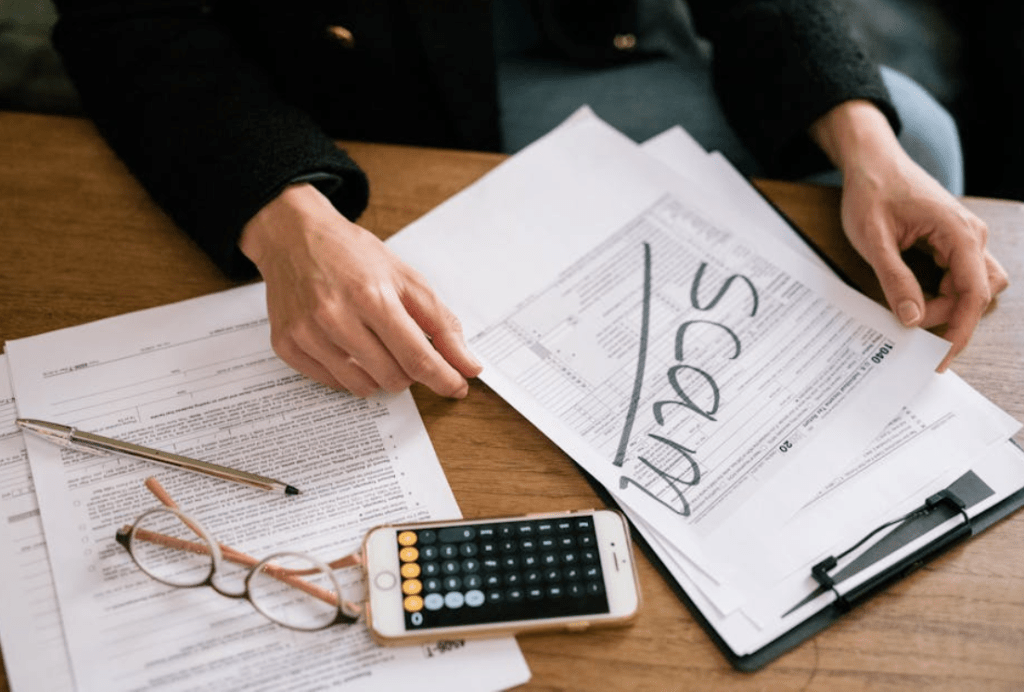

- Tax Fraud: Whistleblowers can report tax evasion or other illegal practices related to tax filings.

- Government Contract Fraud: This involves reporting fraud or misconduct committed by government contractors.

Legal Tips for Whistleblowers

If you are considering blowing the whistle on illegal or unethical activities, it is crucial to understand your rights and protections under the law. Here are some legal tips that can help protect yourself and your case:

- Consult with a whistleblower lawyer: Seeking legal counsel from a whistleblower lawyer specializing in this area can provide valuable guidance and protection.

- Gather evidence: Collect as much evidence as possible to support your claims. This can include documents, emails, recordings, or witness statements.

- Understand the statute of limitations: Each type of whistleblower case has a specific time frame for a claim to be filed. Consult with a lawyer to understand the statute of limitations for your case.

- Be aware of potential retaliation: Whistleblowers may face reprisals from their employers or colleagues. Documenting any instances of retaliation and reporting them to your lawyer is essential.

- Keep your communication confidential: Avoid discussing your case or sharing information with anyone outside of your legal team to protect its confidentiality.

Whistleblower cases are pivotal in uncovering and addressing illegal and unethical activities across various sectors. Understanding the legal framework that governs these cases empowers individuals to navigate the process effectively while safeguarding their rights. Consulting a whistleblower attorney and adhering to critical legal guidelines ensures whistleblowers can come forward safely and effectively. If you possess information about potential misconduct or fraud, do not hesitate to seek legal counsel and take the necessary steps to protect yourself. Your actions could be crucial in driving positive change and holding wrongdoers accountable.