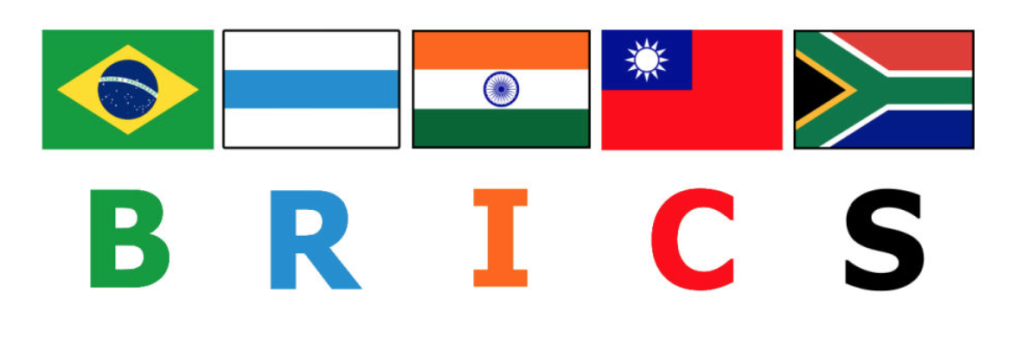

Over the years, aggressive finance policies and challenges surrounding the U.S. dollar have caused some countries to make de-dollarization moves. The BRICS nations, which consist of Brazil, Russia, China, India, and South Africa, are at the forefront of this, actively working towards establishing a new reserve currency independent of the U.S. dollar. This topic is highly controversial, and multiple opinions and deductions are being made on what de-dollarization could mean for the U.S. dollar and the global financial system. This article provides expert opinion on what a BRICS currency could mean for the U.S. dollar.

BRICS: The Biggest Emerging Market Economy

BRICS is an acronym for the world’s leading emerging market economy. The acronym was coined in 2001 as BRIC, after which it became BRICS when South Africa joined in 2010. These markets currently account for 42% of the world’s population, as well as 31% of the Global domestic product (GDP). One of the group’s primary aims is to stand as an independent body outside the aggressive rules and dominance of the U.S. dollar, and we’ve seen several steps taken to achieve this. One of them is the plan to create the BRICS currency, which would be used to facilitate trade and also reduce the exposure to dollar reliance and fluctuation in exchange rates.

The U.S. dollar has been the dominating currency since the end of the Second World War, and following that, it has had major effects on the global financial market. It dominates world trade, the forex trading market, financial policies, and more. This dominance, however, has been accompanied by several drawbacks in recent years. The most notable is the U.S. sanctions on China and Russia, as well as the ongoing trade war with China. These events, coupled with many others, have influenced the BRICS’ decision to find a common currency that the U.S. government cannot ascertain control over.

Can BRICS Affect the Dollar?

A new currency coming into the picture would undoubtedly affect the position of the U.S. dollar as the dominating currency. Presently, aside from the five nations that make up this body, over 40 countries have also shown their interest in the BRICS currency, and we have countries like Egypt, Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE as incoming members of BRICS, come 2024. Such alliances threaten the position of the dollar as the ruling currency. The potential impact of BRICS on the U.S. dollar remains uncertain. Still, experts have deduced possible theories on how this new currency changes the direction of things in the global market. There are multiple ways this new currency could affect the dollar, and most of these could lead to a significant decline in the dollar’s value.

Source: Market, via Devian Arts

Limit to U.S. Sanctions

In the past months, the U.S. has imposed sanctions on certain governments. One recent touchpoint is the sanctions against Russia in response to their war against Ukraine. This happened on the 19th of May, 2023. The U.S. initiated a freeze of about $600 billion reserve of the Russian government. This resulted in the country’s inability to access its reserve assets. We’ve seen other similar instances since the United States established economic sanctions on over 20 countries between 1998 and 2023. All of this has been possible due to how much power the country has as the dominating currency in the global trade and financial market. The BRICS currency could be a worthy challenge to the dollar’s position and ultimately weaken the power of U.S. sanctions.

Alternative to Global Trades

The BRICS currency is seen as a union of several powerful nations across the globe. There are talks of this currency becoming an alternative payment system to the traditional SWIFT platform, as well as a gateway to a non-dollar financial system. With BRICS pay, countries could improve on trades using this currency without relying on the dollar to carry out certain transactions. If this happens, the value of the dollar will weaken significantly.

Accelerate De-dollarization Trends

Source: Emilio Takas, via Unsplash

The de-dollarization trend has been gaining more traction over the years, and in recent conversations on BRICS, the buzz is becoming louder than ever. The BRICS countries have contributed to this buzz, and they might accelerate this trend even more. Countries like Russia and China are already open to trading in their currencies. Kenya, Malaysia, and India are also advocating to dethrone the U.S. dollar, and many more are looking to follow suit.

Bottom Line

The potential impact of the BRICS currency is still uncertain because its launch is still in the negotiation and strategizing phase. It is still very much in its infancy. It would take several years to incorporate a new currency into systems seamlessly and several more years to take over a currency as dominant as the U.S. dollar. However, considering how many nations are involved in this new order, we cannot underestimate what changes can be made and how much this could threaten the dollar’s position as the world’s dominating currency.