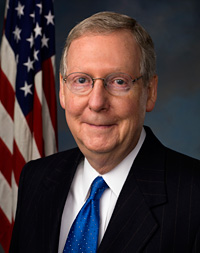

WASHINGTON, D.C. – U.S. Senate Republican Leader Mitch McConnell joined Senator John Thune (R-SD) in introducing the Death Tax Repeal Act of 2013, which would permanently abolish the federal death tax. In addition, the Thune/McConnell legislation sets a lifetime gift tax exemption of up to $5 million, and makes permanent a 35 percent gift tax rate for gifts made over that amount (indexed to inflation).

During a press conference on Capitol Hill Thursday, Senator McConnell said the death tax is the federal government’s final insult to American taxpayers and it needs to be repealed.

“The death tax unduly burdens American families by taxing assets that are handed down from generation to generation, like family farms or small family businesses,” Senator McConnell said. “It is the federal government’s final insult to tax the transfer of your accumulated assets when you have already paid taxes on such assets throughout your life. The thought of having to visit the IRS and the undertaker on the same day is an absolute outrage. This is wrong and it’s why I have consistently supported legislation to eliminate this burdensome tax.”

Between 2009 and 2011, Kentuckians paid more than $225 million in death taxes. Senator McConnell has heard stories from many constituents regarding the impact the death tax is having on them and their families. In fact, one Kentuckian said it would destroy his family farming operation. And another said she worked hard over the years to invest in property — land she owns and inherited — but when she dies, her children would be forced to sell it just to pay the death tax.

Last year, during the fiscal cliff debate, Senator McConnell negotiated with the Vice President to establish a permanent reduction in the death tax to provide Americans the ability to pass their life’s work down to the next generation. Without this change, family farms and small businesses valued at $1 million or more would have been taxed at 55 percent starting in 2013.

“We have made some progress exempting many of Kentucky’s family farms and small businesses from the death tax,” Senator McConnell said. “And I’m proud to join Senator Thune in introducing this repeal bill that will finish the job by abolishing, once and for all, this unfair, anti-American tax.”

maybe and anyone else; I have posted a section from the Iowa sales tax code. I will also post the actual site for you to look at yourself. many are complaining about paying taxes twice. please explain what taxes are paid twice then.

“Generally, self-propelled implements, implements customarily drawn or attached to a self-propelled implement, or grain dryers used directly and primarily in agricultural production and not subject to registration as a vehicle are exempt.

Also exempt are auxiliary attachments which improve the performance, safety, operation, or efficiency of the farm machinery or equipment.

Certain purchases of non-self-propelled machinery or equipment are exempt from the Iowa sales tax if they are used directly and primarily in dairy or livestock production.

Vehicles

Farm tractors, combines, and other such vehicles are exempt because they meet all three of the following requirements: they are used directly and primarily in agricultural production, they are self-propelled, and they are not subject to registration.

Real property

http://www.iowa.gov/tax/educate/faqsales.html#9

the price of a new VERSATILE RT490 combine for 2013 is $400,000 M/L. 5% sales tax on that one item in iowa would be $20,000. thats alot of money folks, just on one item. could we then say farmers welfare???? again Like I said before. I make money from farmers, but lets be real here. This is a form of farmers entitlement. $20,000 saved is $20,000 earned.

I hole-hardedly agree, but allow me to play doubles advocate here for a moment. For all intensive purposes I think you are wrong. In an age where false morals are a diamond dozen, true virtues are a blessing in the skies. We often put our false morality on a petal stool like a bunch of pre-Madonnas, but you all seem to be taking something very valuable for granite. So I ask of you to mustard up all the strength you can because it is a doggy dog world out there. Although there is some merit to what you are saying it seems like you have a huge ship on your shoulder. In your argument you seem to throw everything in but the kids Nsync, and even though you are having a feel day with this I am here to bring you back into reality. I have a sick sense when it comes to these types of things. It is almost spooky, because I cannot turn a blonde eye to these glaring flaws in your rhetoric. I have zero taller ants when it comes to people spouting out hate in the name of moral righteousness. You just need to remember what comes around is all around, and when supply and command fails you will be the first to go. Make my words, when you get down to brass stacks it doesn’t take rocket appliances to get two birds stoned at once. It’s clear who makes the pants in this relationship, and sometimes you just have to swallow your prize and accept the facts. You might have to come to this conclusion through denial and error but I swear on my mother’s mating name that when you put the petal to the medal you will pass with flying carpets like it’s a peach of cake.

Hillari, you are putting us all on, right? hole-hardedly-diamond-petal-granite-appliances-makes the pants-ship-feel-prize-taller ants-make stacks-all around-peach-carpets-petal….none of which are correct in the setting you put them. Yes, we are paying attention. Your English teacher must be really proud of you.

Ay yi yi! That’s some punny stuff there!

I can only hope that she was typing that on a cell phone or tablet and auto correct got her pretty good, if you follow the words, it seems like auto-correct did it, at least I hope that’s the case.

Hillary, I seriously got a chuckle out of your post here but really, don’t bogart it…pass it around ok?

One question, how can you post anything about morals and true virtues after your distasteful downs syndrome link? You expect anyone to take you seriously about actually having any? Just wondering….

Anyone who doesn’t know she’s kidding around is a moron. I thought it was clever and hilarious.

I didn’t think it was funny because I couldn’t figure out what she was trying to say.

Most of the issue of the death tax seems to deal with family farms. If the owner of said farm was too dumb to plan for this eventuality, he deserves what happens. There are people out there whose job it is to convolute the system so that the heirs keep everything with the least financial loss, and it’s all legal. If people are too lazy or too cheap to plan ahead, well, as Sickastupd stated, “Cry me a river”.

I have to agree. Possibly give a tax break on the property where the person actually lived. But lets say the person who died (not always mother,father) had investment property. then it would be unfair to the rest of us that have to pay our taxes on say winnings at the casino. Lets face it, this property was not yours in the first place. YOU HAVE NOT PAID ANY TAXES ON IT, THE PERSON WHO WILLED IT TO YOU DID THAT. this is free winnings to you just like in a casino. pay your fair share.

Also, there are not as many family farms anymore so why are we worried about them now? Because now the farms are investment property for factory farms and corporations that are trying to find a way not to pay their fair share. Maybe no taxes on the first million, and then the rate should be much lower than the 50% mentioned.

That could be a legitimate point. I’ll have to ponder that for awile.

How you doin tonight 5o?

its late, IM asleep

You bring up another point, say you win a million dollars at a casino, if you take the lump sum they almost cut that in half then take out 30% for taxes, then come april you have to pay taxes on that again. I was the manager of a casino in vegas and have seen that many times. I even had to pay myself.

What a bunch of crap. In the first place, it’s not a “death tax”, it’s an “inheritance tax”. Dead people don’t get anything here.

Secondly, if you have assets worth more than a million bucks when you die, it’s your fault. You should have given or sold it all off by now.

Thirdly, if you have a million bucks you ain’t exactly living in poverty, so cry me a river if your spoiled kid only gets a mere 75K for NOTHING.

I call bullshit on this story.

Another liberal who is jealous of anyone who does well financially and thinks it should be divided up among the have-nots instead of passed on to the family it was saved for and intended for. One should not have to jump through a million legal hoops setting up expensive and confusing legal trusts to avoid the tax man when one dies. It’s bull crap, just like it’s bull crap having to pay income tax on 85% of social security when you have already paid tax on that income once. Double taxation is just as heinous as double jeopardy in the court system. It’s about as unfair as anything there is in this country.

Hillarious, you sure had fun with that comment!

Where did you get “jealous” or “divided up among the have-nots” in my post?

Since you’re such a proud, yet clearly poorly educated conservative, let me CUT AND PASTE the important passage in my post:

“Secondly, if you have assets worth more than a million bucks when you die, it’s your fault. You should have given or sold it all off by now.”

See? No mention of dividing anything, no mention of jealousy, merely calling bs when I see it. If you are smart enough to have accumulated sizable assets, you should be smart enough to make sure they don’t get taxes.

I’ll wait here for my apology.

Ok, since you’re smarter than everyone else here. What happens in an accidental death? Why do YOU feel it’s cool to already pay your dues (taxes) and then have to pay them again on what’s left when you die? That’s the bottom line, you pay taxes TWICE. You Liberals are all in bed together i swear.

I’m waiting for your intelligent comment and trust me, I know it WILL be intelligent.

If you people are all too dense to figure out how to legally avoid inheritance tax you deserve what you get. Ask an estate lawyer – heck ask a rich farmer! There’s a reason they’re not screaming about this!

You didn’t answer my question. It was and I will REPEAT…What do you do in the case of an accidental death? I gave you a compliment just before that and said that you were smarter than everyone else on here so I do expect an an answer. You can’t come off acting like you know everything and calling everyone dense when you yourself don’t know the answer. So please….answer the question. IF you can.

My guess is you don’t know the answer. So that makes you just as damn…what did you say??? DENSE. I will now predict EXACTLY what you will do next, since you don’t know the answer you will either…

1. Not repsond at all. OR,

2. You will come back with a beligerent rant and probably name call and STILL not answer the freakin question.

I’m waiting…….

Come off acting like I know everything, beligerent rant, name calling… hmmm… you certainly sound familiar….

Aside from that, the answer lies in the posts by Just Sayin and 50 Miles South, both of whom are saying the same thing as I did.

And you agreed with them. So why is MY post wrong and theirs are right?

As far as accidental death is concerned, see above. Death is death. If your assets aren’t protected you deserve whatever you get.

Sika, I understand what you are saying BUT if my father had done what you are saying before he passed away then my mother would be broke and homeless. As it is she only got less than half of his life insurance from him previous employer and what he purchased later on. To pay off all her bills that money only lasted 2 years, here she is in her 70’s and has to get a job to survive.

@My voice-It sure seems to me that we went to war once and founded a new country all over double taxation and yet here we are again taxing after already paying tax. If a person works hard all of their life to make sure their family is taken care of when they die what gives the government the right to take away that security? The way our government works now is if they can find away to squeeze a penny out of the working man they will do it and give it to those who don’t want to work. Just my opinion.

Maybe, that’s exactly what I’m talking about! That’s why you need to consult a CPA or estate attorney to find out how to protect and maintain your assets. You cannot just leave it up to chance. There are trusts, bonds, investments and outright annual gifts in small doses that will bypass the taxman.

so you are saying is that if I die today in a car accident, all my assets and accounts should go to the government instead of my kids because I didn’t get around to hiring a CPA or a lawyer?

You must not be able to read…I SAID THAT COULD BE A LEGITIMATE POINT. I’LL HAVE TO PONDER THAT FOR AWHILE.

What part of that say’s I agree? You Liberals see what you want to see and hear what you want to hear all the time dont’ you?

So the farmer is building his legacy and has his kids listed as a beneficiary but has NOT put the legacy in their name prior to 5 years before his death due to it being accidental. So that means the kids won the lottery and should pay taxes on it after everything that was accumulated due to hard work had already been paid taxes on by their parents? I don’t think I agree with that at all. The governemnt already got THEIR share on it all once. why do they derserve to get another percentage on it just because it was handed down to their children?

Give all your stuff to the government sweetheart, they’re gonna take it all anyways just like you like right? Why are you so pro government and not pro family? Nobody in your family like you or what?

the kids or whoever, are getting a farm for free. except for taxes. The parents paid for it, not them. So they should expect to pay something. How much is the $64,000 question. So think about this one. Do farmers pay taxes on new machinery? NOPE… used machinery? NOPE…tools and equipment? NOPE… What would be the tax on a new combine anyway?

Also if everyone is complaining about having to pay taxes on what has already been taxed. then please answer why I have to collect sales taxes on all the used items I sell. the used car I just bought. the fertilizer that came out of a horses ass. Dont get me wrong here. Part of my living comes from those farmers having money to spend. I guess IM saying nobody is ever going to be happy as there are soooo many things that should be changed in this country.

PS.. good thing for spell check as I forgot to type an o in that last word.

Ok, wait a minute…so you’re saying when a farmer buys a new combine, they don’t pay sales tax on it?

If I buy a used car, I pay tax on it. BUT, if I go to a garage sale or an auction, should I be sending a check to uncle sam for 50%?

Having grown up on a farm I can tell you that the taxes on a 250,000 combine is more than I make in a year right now and no farmers don’t pay cash for it. People think that farmers are getting all kinds of kickbacks from the government, that maybe so in some cases but when they buy machinery, or seed it’s like us buying a car or a lawnmower or some other type of equiptment to do work, you take out a loan and have to make monthly payments. Taxes are pretty high when you are a farmer.

Maybe I have a question. is the sales tax rate on a new combine 5% or 7% sales tax?

I really don’t know, all I did was drive them.

Amen, Katie!

“Secondly, if you have assets worth more than a million bucks when you die, it’s your fault. You should have given or sold it all off by now.”

So that you can tax it at the point of sale/gift?

“I call bullshit on” your comment.