MASON CITY – The City Council will conduct a public hearing on the proposed 2018 Budget at Mason City Room of Library on March 7, 2017 at 7:00 PM.

MASON CITY – The City Council will conduct a public hearing on the proposed 2018 Budget at Mason City Room of Library on March 7, 2017 at 7:00 PM.

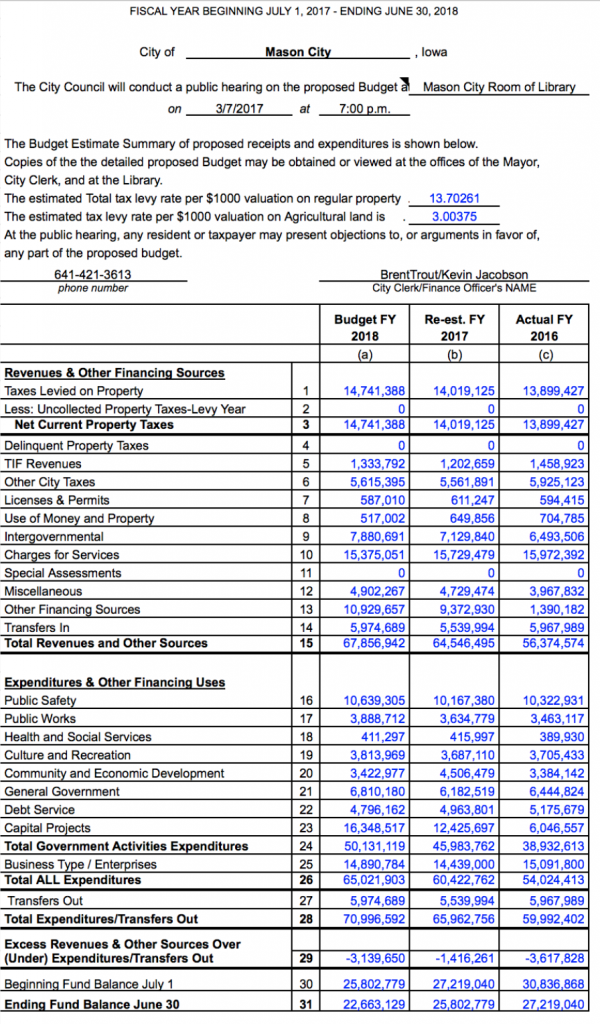

The Budget Estimate Summary of proposed receipts and expenditures is shown below.

The estimated Total tax levy rate per $1000 valuation on regular property: 13.70261

The estimated tax levy rate per $1000 valuation on Agricultural land is: 3.00375

At the public hearing, any resident or taxpayer may present objections to, or arguments in favor of,

any part of the proposed budget.

IMPORTANT NOTES:

- Anticipated TIF bonding of $8 million for both 2017 and 2018 – (not guaranteed revenue, as it is a projection, only) – is included in the estimated 2017 and 2018 budgets. This is why revenues show higher for those 2 years’ projected budgets. “A budget is a PLAN – not actual dollars spent,” Finance Director Kevin Jacobson told NIT Monday afternoon.

- Mr. Jacobson also informed NIT that the city’s initiative to re-assess property values is paying off for the city. The ledger shows that projected revenues to be collected on taxes levied on city property is up dramatically, from about $13.9 million in 2016 to over $14.7 million (again, projected) in 2018. The key point is that this projected revenue in 2018 can be “much more accurately” projected than expenditures, because the new tax is easily calculated on the new property valuations that the city assessor has already turned in and is currently rounding up. That was a $1 million project that the taxpayers paid for after a 2013 Conference Board meeting.

Ag land is taxed on income – how about the same for the poor folk that work for a living – I heard half of our elected officals own farm land –any connection with low ag taxes and 5 billion dollars in Iowa welfare farm subsides ?

Higher assessments plus the levy increase… so obvious! People will be movingaway, making a lower population and tax base. We need a new mayor and council to turn this #@* around and first on the agenda,,,FIRE TROUT!!! So tired of these crooks & big spenders!!! VOTE NO on levy!

Are you willing to reveal whether you voted for Bransatd for Governor? His multi million dollar commercial property tax break is far more to blame for this than Brent Trout. And we’re far from done yet. Branstads commercial property tax breaks will continue to increase for several more years. Cities across Iowa will have to continue to increase residential tax assessments to make up the difference.

Trout needs to resign immediately

valuation on regular property: 13.70261,

Agricultural land is: 3.00375,

This can’t be right.

In Iowa, agricultural land is valued based on its productivity and net earning capacity, not on what it would sell for, so it’s usually valued (and taxed) a lot lower than if it was used for something else.

OK, so I’m confused. Why then is my acre of ground which doesn’t produce anything, and has zero earning capacity taxed at a higher rate. Hypothetically, 40 bushels per acre for soy beans at $8.00 a bushel, is $320. And I pay tax on the fuel I use.

Most of our jobs that are retail and food dont pay over 10.00 an hour. These people dont own houses so us that do and landlords are going to have to bite the bullet. OUCH

now if you divide $800,000 by the number of residents 28,000 you get that’s $28.57 per person raise now a family of 4 is going to be paying over $100 a yr more in taxes plus the levy, there goes the grocery money

Theives.

I guess they won’t be needing the levy then.

That’s what I’m thinking.

The funkies that did this WILL NOT be re elected – Says sa ME !

They will just have new ones to replace them same agenda different person, they do not care about $ they just don’t want people/Goyim/cattle to have $, all roads lead to Rome.

I;m sure the small business owner are glad that $800,000.00 was removed from their economy that is in deep chit.

You really don’t own your property – just think of this as rent to the thieves in power. They just took 800k out of your economy and gave themselves raises.