By Tony Pugh, McClatchy Newspapers –

WASHINGTON — It was supposed to provide a measure of restitution on behalf of homeowners who lost equity in the market collapse or lost their homes in the “robo-signing” foreclosure scandal.

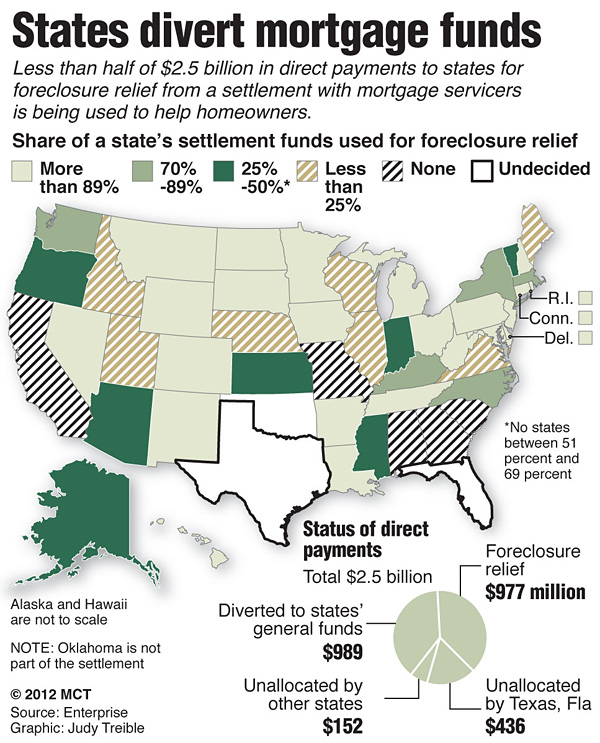

But after the states split their $2.5 billion share of the landmark National Mortgage Settlement in February, less than half of the money states have allocated will be used as intended — to aid in stopping preventable foreclosures and financial fraud and to help stabilize communities scarred by the housing crisis.

The settlement did not require states to spend the bulk of their share on housing, but that was the intent.

While states have announced plans to use $977 million of their direct payments for housing and foreclosure-related assistance, $989 million will go to fill budget shortfalls or for non-housing purposes, according to a report released Thursday by Enterprise Community Partners, a national affordable housing and community development group.

The report, which updated an earlier analysis, found that six states — Missouri, California, South Carolina, Georgia, Alabama and New Jersey — ignored the agreed-upon uses for the money entirely by directing nothing for housing-related activities.

It said that 23 states are using all, or nearly all, of their settlement money for housing, while five others — New York, North Carolina, Washington, Massachusetts and Kentucky — have dedicated between 70 percent and 89 percent for housing purposes.

Fourteen others, including Idaho and Illinois, are using less than half of their funds for the intended purposes.

Andrew Jakabovics, co-author of the report and senior director of policy development and research at Enterprise, said he understood the pressure on state budgets, but that states “should do the right thing by respecting the specific language, if not the intent,” of the settlement.

Alan Jenkins, executive director of The Opportunity Agenda, a social advocacy group, called the states’ actions “economically shortsighted” and “morally bankrupt,” because states would benefit from increased tax revenue by assisting troubled homeowners.

Jenkins said minority communities and military personnel were specifically targeted for some of the worst mortgage abuses, but many did not benefit from the settlement.

“When these states get this money and dump it into their general coffers, it means that they’re not benefiting the very people that were victimized in any kind of responsive way,” he said. “It’s not that these mortgage abuses occurred randomly. They targeted some of the most vulnerable communities intentionally, and now that some measure of remedy has been extracted from the banks, it’s appalling that some states are not targeting that toward fixing the problems.”

The $2.5 billion in direct payment to states was part of the $25 billion national settlement negotiated between the federal government, 49 states and the District of Columbia to address past improprieties by five large mortgage servicers; Ally (formerly GMAC), Bank of America, Citi, JPMorgan Chase and Wells Fargo. Oklahoma opted out of the settlement.

These include “robo-signing,” the forging of signatures on foreclosure documents to speed up the process without the proper review.

Oklahoma chose to opt out of the settlement because state officials disagreed with premise of the investigation.

In addition to the money for states, the companies agreed to provide $17 billion in principal reductions and loan modifications, up to $3 billion in refinancing relief, and additional money to borrowers who lost their homes.

Many states felt the pull of other needs.

Missouri lawmakers used most of their $39.5 million to offset cuts in state higher education funding, the report found. Georgia steered its entire $99 million share of the settlement toward economic development programs.

In South Carolina, Republican Gov. Nikki Haley vetoed legislation that would have redirected the state’s entire $31.3 million settlement from its intended purposes. But the Republican-controlled state Senate overrode Haley’s veto and shifted $21 million to the general fund and $10 million to a state fund that provides incentives for companies to relocate to South Carolina, according to the report.

In California, which received nearly $411 million, the settlement agreement said the state would use 10 percent of the money as civil penalties and the remaining $360 million for housing-related services, including counseling and consumer protection investigations.

But Democratic Gov. Jerry Brown decided in May to use the money to help fill the state’s $15.7 billion budget shortfall. The attorney general’s office ended up keeping $18.4 million as civil penalties, the report said, with only a small portion going for housing counseling and to a state fair housing agency.

Of the nearly $588 million in settlement payments to states that remains to be allocated, Florida and Texas make up the vast majority, with $301 million and $134.6 million, respectively.

Florida’s share is in escrow until a dispute between the attorney general and the legislature is settled over who has authority to allocate the money. Texas lawmakers will decide how to spend their share when the legislature convenes in 2013.

On Tuesday, an alliance of fair housing organizations sent 35,000 signed postcards to the Chicago campaign headquarters of President Barack Obama and the Boston campaign office of Republican presidential nominee Mitt Romney.

The cards urged both to do more to stop preventable foreclosures, expand affordable housing options and place more campaign emphasis on the nation’s continued housing crisis.