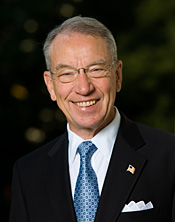

“A college education generally remains a good investment,” Grassley said. “But when students’ academic dreams become a nightmare upon graduation because they borrowed more from the federal government than they can afford to repay with the degree they earned, they understandably feel something is wrong. The federal government, as the lender, has a responsibility to at least ensure that students know what they’re getting themselves into before they get in over their heads. My legislation will do that.”

Grassley’s Know Before You Owe Federal Student Loan Act strengthens the current loan counseling requirements for institutions of higher education in the Higher Education Act by making the counseling an annual requirement before new loans are disbursed rather than just for first-time borrowers. The bill then adds several key components to the information institutions of higher education are required to share with students as part of loan counseling, including:

• An estimate of the student’s projected loan debt-to-income ratio upon graduation based on the starting wages for that student’s program of study and the estimated total student loan debt the student will likely take out to complete the program.

• A statement that the student should borrow the minimum amount necessary to cover expenses and that the student does not have to accept the full amount of loans offered.

• A warning that a higher the borrower’s debt-to-income ratio is, the more difficulty the borrower is likely to experience in repaying the loan.

• Options for reducing borrowing through scholarships, reduced expenses, work-study or other work opportunities.

• An explanation of the importance of graduating on time to avoid additional borrowing, what course load is necessary to graduate on time, and information on the impact of adding an additional year of study to total indebtedness.

The bill requires that a student manually enter, either in writing or through electronic means, the exact dollar amount of federal direct loan funding that the student desires to borrow. This ensures that students make a conscious decision about how much they borrow rather than simply accepting the total amount of loans for which they are eligible.

The Know Before You Owe Federal Student Loan Act also would provide that students receive regular loan statements while they are in school just like they will when they graduate and start repaying. That way, students will be more aware of their level of indebtedness and will be encouraged to at least pay any interest that accrues. This will help students be more mindful of the debt they are taking out, encourage students to control their expenses, and discourage over-borrowing.

Grassley said several Iowa programs helped to inspire and inform his Know Before You Owe Federal Student Loan Act.

Grassley’s alma mater, the University of Northern Iowa, created a program five years ago with the theme “Live Like a Student.” The program includes workshops and courses designed to educate students on the importance of living within their means while they are in school so they need not live like a student later in life. As a result, the university has lowered average student debt from more than $26,000 to $23,163.

Grand View University has a Financial Empowerment Plan where students and families construct a comprehensive four-year financing plan. Under this plan, borrowing is based on the student’s future earning potential in the student’s field of study. The four-year plan also helps ensure students graduate on time and tuition increases are capped at 2 percent a year over those four years.

Iowa Student Loan, the state-based nonprofit lender, also has a program called the Student Loan Game Plan, an online, interactive resource that calculates a student’s likely debt-to-income ratio. It walks students through how their borrowing will affect their lifestyle in the future and what actions they can take now to reduce their borrowing. As a result, in the past year, 18.2 percent percent of students who participated decreased the amount they had planned to borrow by an average of $3,680, saving students $2.1 million in additional loan debt.

Grassley said he hopes the Know Before You Owe Federal Student Loan Act will be included in the re-authorization of the Higher Education Act, which governs federal higher education programs. The Higher Education Act expires Sept. 30. The current law will need to be extended or a new law will need to be enacted. The committee of jurisdiction, the Health, Education, Labor and Pensions Committee, could consider a new version in the coming months.

Grassley has worked on additional proposals on student debt. He was the lead Republican co-sponsor in the last Congress of the Net Price Calculator Improvement Act of 2014 to improve the effectiveness of and access to net price calculators, which provide students with early, individualized estimates of higher education costs and financial aid figures before they decide where to apply.

For years, Grassley has worked on the bipartisan Understanding the True Cost of College Act that would create a universal financial aid award letter to help students better compare colleges’ financial aid offers and costs.