Harkin, Udall, Sanders Urge Tax Incentives for Working Families –

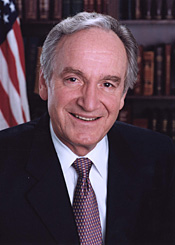

WASHINGTON, D.C. – U.S. Senators Tom Harkin (D-IA), Tom Udall (D-NM), and Bernie Sanders (I-VT) have introduced legislation to support the economic recovery by offering a tax incentive for working families. The 2013 Making Work Pay Tax Credit Act, S.3680 (MWPTC) does so by boosting the income of hardworking low- and middle-income taxpayers who are more likely to quickly spend their additional income and spur economic growth. The lawmakers are proposing it as a replacement to the two percent Social Security payroll tax holiday, which is scheduled to expire on December 31, 2012.

“This is a simple, straightforward proposal that offers incentives for work to those who need it and will use it the most: working families,” said Harkin. “It gives a boost to the whole economy without jeopardizing the integrity of the Social Security Trust Fund.”

“As our economy recovers, middle-class families continue to struggle and can’t afford to see their taxes go up,” said Udall. “Our proposal is a responsible, targeted alternative to provide hard working families much-needed assistance.”

“Middle class workers deserve tax relief, but not at the expense of Social Security,” said Sanders. “Replacing the Social Security payroll tax cut with a tax credit for working families will provide more tax relief to those who need it most and will not jeopardize Social Security’s future. This legislation is the right thing to do.”

Unlike the Payroll Tax Holiday, the Making Work Pay Credit does not have the potential to undermine the Social Security Trust Fund. The current two percent Social Security payroll tax holiday requires that general funds are transferred into the Social Security trust funds to make up for the loss of payroll tax revenues, which undermines the basic principle that Social Security is a self-funding program.

Under the Making Work Pay Tax Credit Act of 2013, tax filers would receive a six percent credit up to a maximum of $800 for an individual and $1600 for a jointly-filing couple, double the amount provided in 2009. For example, an individual would receive the full $800 if they had earned income over $13,334 and a couple would receive $1,600 if their income was over $26,667. By contrast, under the current payroll tax holiday, it would take three times as much income to reach that level of benefit.

The bill would begin to phase out the credit for individuals with income over $60,000 and would completely eliminate the benefit at $90,000. For joint filers, it would begin to phase out at $90,000 and completely phase out at $150,000.