By David Lightman and Kevin G. Hall, McClatchy Newspapers –

WASHINGTON — A Republican proposal Monday to shave $2.2 trillion off projected budget deficits sets up a fiscal-cliff showdown with the White House because the plan includes reductions in the very tax rates that Democrats seek to raise.

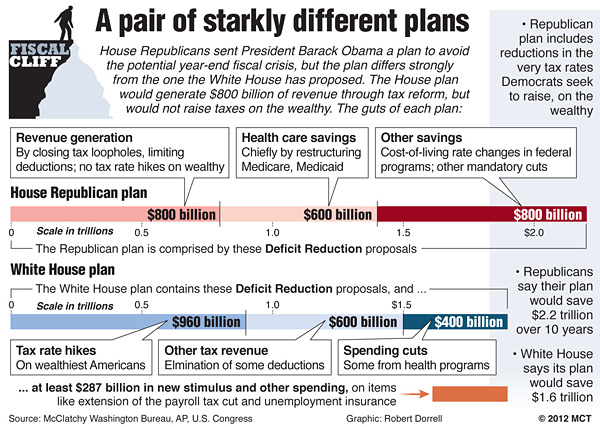

The Obama administration’s opening offer sought to raise $1.6 trillion in taxes over 10 years, much of it from higher income-tax rates on the wealthy. Republican leaders in the House of Representatives countered Monday with their own offer, saying their plan would raise $800 billion in new tax revenues but basing that on cuts in tax rates coupled with limits on deductions that would make more income taxable.

The plan, contained in a three-page letter signed by seven House Republican leaders, is a counteroffer to last week’s Obama administration proposal. Aimed at jump-starting stalled talks, the proposal instead sharpens the battle lines with just four weeks to go until temporary tax cuts expire for all Americans and automatic spending reductions start going into effect.

The Republican offer included:

—$1.2 trillion cut from projected spending over the coming decade.

—$800 billion in new tax revenues.

—$200 billion from changes to a wide variety of federal programs that might include new ways of calculating cost-of-living increases.

No money is included for economic stimulus; the Obama plan sought $50 billion in one year. Nor is any mention made of increasing the nation’s debt limit.

That’s significant, because the White House is seeking an easier way to approve increases that allow new debt to be issued to cover existing obligations. The federal government is expected to start bumping up against the $16.3 trillion debt ceiling late this month, and extraordinary measures to move money around could buy another two months, three at most, before the United States defaults on some of the debt it owes, absent establishment of a new ceiling.

The White House panned the proposal as unbalanced.

“In fact, it actually promises to lower rates for the wealthy and sticks the middle class with the bill,” White House spokesman Dan Pfeiffer said in a statement. “While the president is willing to compromise to get a significant, balanced deal and believes that compromise is readily available to Congress, he is not willing to compromise on the principles of fairness and balance that include asking the wealthiest to pay higher rates.”

House Speaker John Boehner, R-Ohio, argued Monday that the White House offer “couldn’t pass the House and couldn’t pass the Senate.”

The $800 billion in tax revenue, which Republicans contend is a significant concession, wouldn’t be achieved through higher tax rates, “which we continue to oppose and will not agree to in order to protect small businesses and our economy,” the House Republicans’ letter said.

“Instead, new revenue would be generated through pro-growth tax reform that closes special interest loopholes and deductions while lowering rates,” they argued.

The White House’s proposal seeks to raise $600 billion over a decade by eliminating tax deductions, and $960 billion over 10 years by raising marginal tax rates for the top 2 percent of income earners.

The $1.2 trillion in proposed spending cuts includes $300 billion in savings on discretionary programs, or spending that Congress and the White House can control more easily. Such programs usually include education, housing and transportation.

The other $900 billion would come from so-called mandatory programs and health care, presumably Medicare, Medicaid and other programs in which spending is often subject to automatic formulas.

The GOP plan wasn’t specific, although the letter to the president noted that a House-passed budget resolution assumes “enactment of structural Medicare reform.” The White House hasn’t been too specific, either, and that’s troubling to budget watchdog groups.

“The big deal is health care spending,” Alice Rivlin, a former Federal Reserve vice chairman, said Monday.

Rivlin and former New Mexico Republican Sen. Pete Domenici, who headed the Senate Budget Committee during past tax deals, offered an updated version of a plan they co-authored at the Bipartisan Policy Center. Their plan includes graphics showing that health care spending is the driver of the nation’s fiscal problems, and both rapped the administration for not spelling out more clearly what it envisions for mandatory spending programs.

“You can’t get to a solution unless you do entitlement reform,” said Domenici, now an elder statesmen.

The Republicans haven’t publicly worked out the process for approving any of their proposals. Some presumably would be passed before Dec. 31, when the Bush-era tax cuts are due to expire and automatic spending cuts totaling $109 billion are to take effect in January. Other pieces would be passed later, though the two sides would be expected to create a framework for consideration.

“What we’re putting forth is a credible plan that deserves consideration from the White House,” Boehner said.

In the Senate, where Republicans haven’t offered a plan, Minority Leader Mitch McConnell of Kentucky was sympathetic to the House offer.

“While the president hasn’t moved an inch away from his efforts to please his radical left-wing base, the speaker has consistently shown a good-faith effort to find common ground and a realistic approach to solving the very real economic problems facing our country,” McConnell said.

@ LVS- I don’t really care how anyone lives their life, as long as it doesn’t affect me. I’m 64, retired, and when I was planning for my future, I worked under the assumption that SS would not be there to help me out. So any SS benefits I get are just extra money. I just don’t care to hear about people complaining about SS or SS cuts when they didn’t do anything themselves to plan for their future. Life is choices. And if people didn’t choose to plan for their future, due to the way they lived their lives or for whatever reason, they don’t deserve to have a future. Everyone is responsible for their own actions.

@citizen-Again, I do not need a lecture from you or anyone on how social security is supposed to work. You don’t know my circumstances or finances. I paid into social security and to me it is just like a bank account that I have PAID for. No different than if someone owed me money. I would go after it. I am in pretty good shape compared to a lot of people out there. I know lots of folks that have nothing but social security and you can say all you want that they didn’t save but the fact is that is all they have. I also know a few that lost a good portion of their income due to the recession.

@ LVS- Didn’t mean to ruffle your feathers. You live your life and I’ll live mine. Some people enjoy complaining about life. I just play the cards I’m dealt.

@citizen-I just wanted to point out that there are circumstances that happen that people can not control. I have had some medical issues that now drive most of my thinking. From my point of view the Golden Years SUCK.

let me put it real simple. we are printing money to pay back the money borrowed from SS. If you don’t see a problem you should not even have a checking acct

LVS…you probably didn’t vote for the GOP this time, listening instead to the Demo propaganda that those already retired would be the losers…when in fact it is those who will be as it now stands, excluding anything either party might do to lower the debt.

SS has no money, anyway. If you don’t believe that then why did the president threaten not to send out Social Security checks during the last confrontation over the debt limit? There is no trust fund, unless to you to consider those worthless IOUs sitting in Treasury which are only as good as the US being able to “cash” them. The money has been spent since day one (1935) on everything including SS.

The same holds true for Medicare. The money paid in each year goes out faster than it is replenished.

Good luck on voting for the other party—they are the ones who started the whole “now you see it, now you don’t”.

The Republicans in Congress are not the ones who crammed “Obamacare” down our throats…..remember?

If they should be so stupid as to cut existing Social Security they will find a whole bunch of very angry old folks. Most of our cost of living increases are less than $50 p/mo. A drop in the bucket in the overall problem. Let them cut their own salary’s and medical insutance if they want to save big money. It makes absolutely no sense at all to cut medicare and medicade when they are trying to get coverage for everyone under Obamacare. Where do they think retired people are going to get the cash to make up the difference. It isn’t like we can work overtime. If this goes through it shows me that the Republicans are not the party of retired people and I won’t ever vote for one again.

Social Security was never meant to be a live on retirement fund. It was meant to be there to assist older people in their later years. If they did not have the foresight to make some plan for their own comfort and subsistance, that is their own fault. And please don’t tell me people couldn’t afford it. If a person lives 65 years, there is something(s) that they chose as a want rather than a need. Cigaretts, telephone, drove when they could have walked, etc. I do agree that health care/prescription costs need to be addressed. But Social Security? No. That should be an aid, not an anchor.

SS has nothing to do with the problems that the USA is facing now. It is solvent of the next 35 years and 75% solvent after that. In fact the US government owe’s SS some 2 trillion dollars. The republicans or the democrates should not include any changes to SS in their attemps to fix the fiscal cliff issues.

@citizen-I do not need a lecture from you or anyone else on how I live my life. I paid into social security for well over 50 years and if it isn’t there to HELP with my retirement just give back what I paid in. If the government would just pay back what they have “borrowed” over the years there would be no problem. There still isn’t for at least 20 years. If they want to save money take it out of oil subsidy’s, wind subsidy’s or farm subsidy’s. These are all going to finance millionairs. Leave the income alone that millions of people depend on. And yes, I did vote Republican this time but if this goes through I won’t again.