MASON CITY – The City Council will conduct a public hearing on the proposed 2018 Budget at Mason City Room of Library on March 7, 2017 at 7:00 PM.

MASON CITY – The City Council will conduct a public hearing on the proposed 2018 Budget at Mason City Room of Library on March 7, 2017 at 7:00 PM.

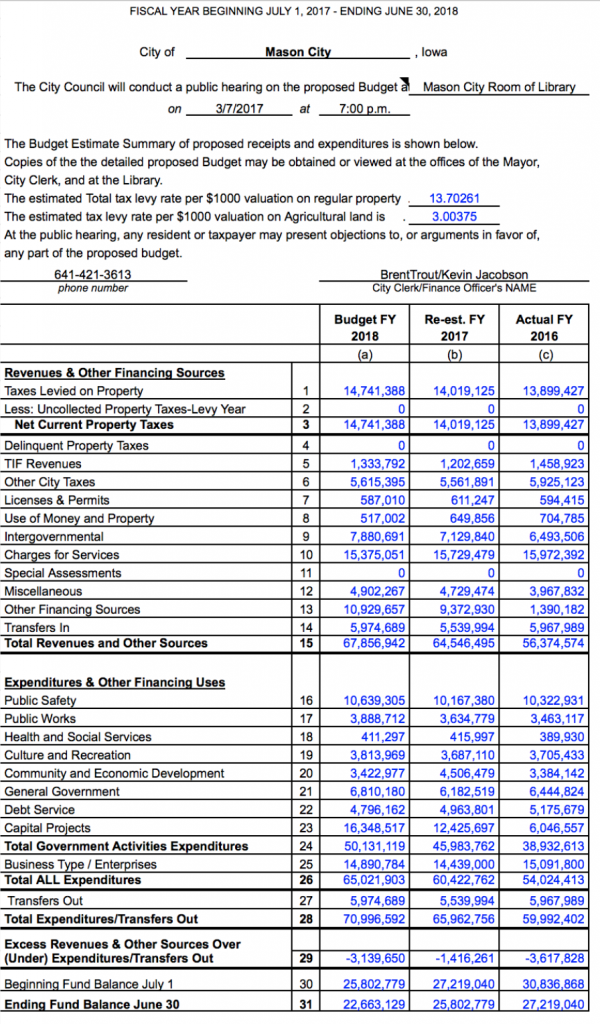

The Budget Estimate Summary of proposed receipts and expenditures is shown below.

The estimated Total tax levy rate per $1000 valuation on regular property: 13.70261

The estimated tax levy rate per $1000 valuation on Agricultural land is: 3.00375

At the public hearing, any resident or taxpayer may present objections to, or arguments in favor of,

any part of the proposed budget.

IMPORTANT NOTES:

- Anticipated TIF bonding of $8 million for both 2017 and 2018 – (not guaranteed revenue, as it is a projection, only) – is included in the estimated 2017 and 2018 budgets. This is why revenues show higher for those 2 years’ projected budgets. “A budget is a PLAN – not actual dollars spent,” Finance Director Kevin Jacobson told NIT Monday afternoon.

- Mr. Jacobson also informed NIT that the city’s initiative to re-assess property values is paying off for the city. The ledger shows that projected revenues to be collected on taxes levied on city property is up dramatically, from about $13.9 million in 2016 to over $14.7 million (again, projected) in 2018. The key point is that this projected revenue in 2018 can be “much more accurately” projected than expenditures, because the new tax is easily calculated on the new property valuations that the city assessor has already turned in and is currently rounding up. That was a $1 million project that the taxpayers paid for after a 2013 Conference Board meeting.